Retail sales in the U.S. increased by 0.4% in September, surpassing expectations and signaling continued economic resilience in the third quarter. This follows a modest 0.1% gain in August, according to the Commerce Department. Economists had anticipated a 0.3% rise, with estimates ranging from no change to an 0.8% increase. …

Read More »ECB Cuts Rates for Second Straight Meeting to Combat Inflation and Economic Slowdown

The European Central Bank (ECB) reduced interest rates by a quarter point at its second consecutive meeting on Thursday, aiming to address sluggish inflation and weak economic growth. This marks the first back-to-back rate cut in 13 years, signaling a shift in the ECB’s policy focus from controlling inflation to …

Read More »Euro Drops to Two-Month Low as ECB Rate Cut Approaches

The euro fell to a more than two-month low on Thursday ahead of an anticipated European Central Bank rate cut, while the dollar surged to its highest level in 11 weeks due to expectations that Donald Trump, whose policies are viewed as favorable by the market, will win the upcoming …

Read More »European Stocks Edge Up as Investors Eye ECB Rate Cut and Mixed Earnings

European stocks edged higher on Thursday, as investors anticipated a dovish tone from the European Central Bank (ECB) following its widely expected interest rate cut. The continent-wide STOXX 600 index inched up 0.1% at 0713 GMT, recovering slightly after a two-day decline. Key Gainers and Earnings Highlights Finnish bank Nordea …

Read More »Oil Prices Flat as Investors Watch Middle East Developments and U.S. Inventory Data

Oil prices traded flat on Thursday as investors remained cautious about geopolitical tensions in the Middle East and awaited more information on China’s economic stimulus plans. Traders were also looking ahead to the release of U.S. oil inventory data for further market direction. Brent crude futures dipped by 4 cents …

Read More »Gold Near Record Highs as Softer Yields, Central Bank Rate Cuts Support Prices

Gold prices rose slightly in Asian trading on Thursday, staying close to record highs despite a strong U.S. dollar fueled by speculation of a second Trump presidency. The rise in gold was supported by lower Treasury yields and expectations of interest rate cuts from major central banks. Spot gold climbed …

Read More »Dow Jones tries to recover 17/10/2024

Oil, Crude, trading

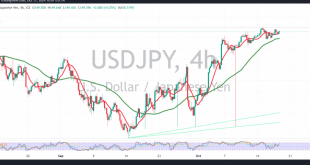

Read More »USD/JPY Repeats Upside Chances 17/10/2024

japanese-yen

Read More »GBP extends losses against USD 17/10/2024

Oil, Crude, trading

Read More »Oil: Negativity persists 17/10/2024

US crude oil futures remain in a downtrend, recording a low of $69.68, approaching the first target of $69.65 per barrel. Technical Outlook: The bearish double top pattern on the 4-hour chart continues to exert negative pressure on prices. With trading stability below $71.20, the downtrend is likely to persist, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations