European stock markets fell on Tuesday morning as investors assessed fresh economic data from the region, particularly inflation and employment figures, alongside quarterly earnings updates from key corporations. At 03:10 ET (08:10 GMT), Germany’s DAX was down 0.9%, France’s CAC 40 dropped 1%, and London’s FTSE 100 slipped by 0.4%. …

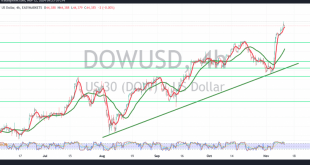

Read More »Dow Jones needs extra momentum 12/11/2024

Oil, Crude, trading

Read More »USD/JPY continues gradual rise 12/11/2024

japanese-yen

Read More »GBP continues its gradual decline 12/11/2024

Oil, Crude, trading

Read More »Oil continues to make losses 12/11/2024

US crude oil futures prices experienced a significant decline in the last trading session, aligning with the bearish outlook, and met the forecasted targets at 68.55, hitting a session low of $67.84 per barrel. Technical Analysis: Bearish Bias: Oil prices are currently under negative pressure, with trading stability below 68.60. …

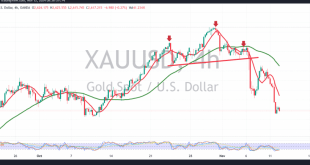

Read More »Gold is subject to heavy selling 12/11/2024

Gold experienced strong selling pressure, maintaining its downward trend and surpassing the target station of 2647, with prices dropping to a low of $2610 per ounce. Technical Analysis: Bearish Outlook: Today’s analysis indicates a continued bearish sentiment, as gold remains below the simple moving averages, which reinforce the likelihood of …

Read More »Euro continues to fall against dollar 12/11/2024

The Euro experienced a significant decline against the U.S. Dollar, in line with previous expectations, after successfully breaking the 1.0680 support level. This move took the pair down to its initial target at 1.0665, coming close to the next key station at 1.0610, with a recorded low of 1.0628. Technical …

Read More »Market Review: Euro Dips to 4-Month Low Against Dollar Amid Tariff Fears and U.S. Policy Uncertainty

The euro fell to its lowest level in 4 and a half months against the U.S. dollar on Monday, as concerns about potential U.S. tariffs weighed heavily on the currency and investors reacted to growing uncertainties surrounding U.S. economic policy under President-elect Donald Trump. At 10:00 GMT, the euro was …

Read More »Oil Prices Hold Steady as U.S. Storm Concerns Subside and China’s Stimulus Plan Falls Short

Oil prices remained relatively unchanged on Monday, as concerns over potential supply disruptions from a storm in the U.S. Gulf of Mexico eased, and disappointment over China’s stimulus plan weighed on expectations for future fuel demand growth in the world’s second-largest oil consumer. By 07:14 GMT, Brent crude futures were …

Read More »European Stocks Rise Amid Wall Street Momentum and Federal Reserve Rate Cut

European stock markets kicked off the week on a high note, buoyed by record gains from Wall Street and recent moves by the U.S. Federal Reserve to lower interest rates. By 03:10 ET (08:10 GMT), key indices showed robust gains: Germany’s DAX was up 1.1%, France’s CAC 40 increased by …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations