US crude oil futures have shown a strong upward momentum, crossing a key resistance level at 68.65, signaling a shift toward a potential bullish trend. Technical Analysis Overview:On the 240-minute chart, the technical setup is promising, with the 14-day momentum indicator attempting to generate positive signals. Furthermore, the 50-day simple …

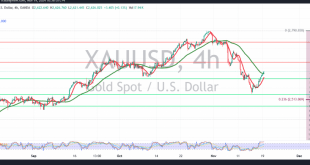

Read More »Gold starts positively 19/11/2024

Gold prices showed strong upward momentum in the previous session, successfully building on the support level of 2567 and reversing the anticipated downward trend from the prior analysis. As highlighted earlier, surpassing 2604 was a significant catalyst, paving the way for a potential shift toward an upward trajectory, with prices …

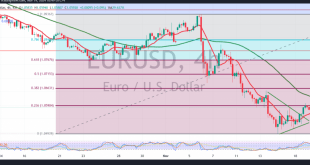

Read More »Euro retests resistance 19/11/2024

The Euro made some gains against the US Dollar during the previous trading session, attempting to retest the psychological barrier resistance level at 1.0600. From a technical standpoint, the pair is currently hovering around this resistance, which aligns with the 23.60% Fibonacci correction on the 4-hour chart. The Stochastic indicator …

Read More »Oil Prices Dip Slightly Amid Demand Concerns and Supply Worries

Oil prices edged lower in early Asian trading on Tuesday, stabilizing after significant gains in the prior session. The decline followed concerns about global demand and a potential supply glut, despite the market’s reaction to recent supply disruptions and geopolitical tensions. Modest Decline in Oil Futures Brent crude futures for …

Read More »U.S. Dollar Eases Slightly from One-Year High as Market Awaits Fed Commentary

The U.S. dollar retreated modestly on Monday from a one-year high, entering a week with few significant economic data releases but multiple Federal Reserve speeches. At 04:50 ET (09:50 GMT), the Dollar Index, which measures the greenback against six major currencies, dipped 0.1% to 106.497, slightly off the peak of …

Read More »Gold ignores US Retail Sales DataDollarGold ignores US Retail Sales Data

Gold prices experienced a strong rebound on Monday, rising around 1% following last week’s losses, as the U.S. dollar rally showed signs of slowing. The precious metal gained ground amid anticipation of comments from Federal Reserve officials, which are expected to provide clues on future interest rate decisions. As of …

Read More »European Shares Decline Amid Real Estate and Tech Weakness; Investors Eye ECB Guidance

European shares slipped on Monday, marking further losses in the wake of recent setbacks. The STOXX 600 index dropped 0.2% by 0909 GMT, extending concerns from a four-week losing streak. This decline, the longest in 2.5 years, was fueled by disappointing earnings, rising Treasury yields, and uncertainty over U.S. President-elect …

Read More »Oil Prices Rise Amid Russia-Ukraine Tensions, but Demand Concerns Linger

Oil prices saw a slight uptick on Monday as intensifying conflict between Russia and Ukraine over the weekend raised supply worries, although market gains were capped by concerns about fuel demand in China and expectations of a global oil surplus. By 0502 GMT, Brent crude futures increased by 29 cents, …

Read More »Dow Jones: Downside pressure persists 18/11/2024

Oil, Crude, trading

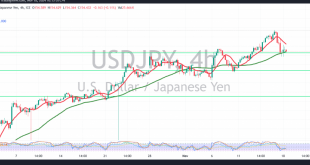

Read More »USD/JPY Retests Support 18/11/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations