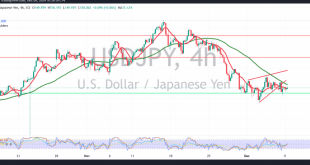

japanese-yen

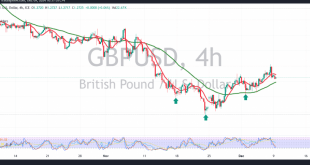

Read More »GBP may repeat its rising chances 9/12/2024

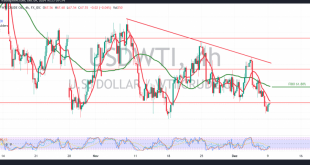

Oil, Crude, trading

Read More »Oil: Negative pressure persists 9/12/2024

US crude oil futures prices continue their bearish trajectory, aligning with the previous negative outlook. The price reached the official target at 67.00, recording a low of $67.05 per barrel. Technical Analysis: 240-Minute Chart Observations: The simple moving averages maintain downward pressure. The 14-day momentum indicator shows strong negative signals, …

Read More »Gold needs catalysts 9/12/2024

Gold prices continue to trade within a sideways range, remaining constrained between 2620 as support and 2655 as the main resistance level. Technical Analysis: 4-Hour Chart Insights: The simple moving average is attempting to provide a positive push to prices. Meanwhile, the Stochastic indicator shows persistent negative signals, reflecting conflicting …

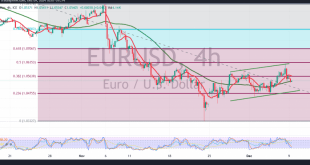

Read More »Euro seeks additional momentum 9/12/2024

The EUR/USD pair ended last week’s trading on a bullish note, surpassing the 1.0560 resistance level and reaching the target of 1.0635, marking its highest level at 1.0635. Technical Analysis: Momentum Indicators: The 240-minute chart shows support from the 50-day simple moving average, alongside the Stochastic indicator signaling positive momentum, …

Read More »U.S. Nonfarm Payrolls Exceed Expectations with Strong November Growth

The U.S. labor market demonstrated resilience in November as Nonfarm Payrolls (NFP) increased by 227,000, according to the Bureau of Labor Statistics (BLS) report released on Friday. This robust figure surpassed market expectations of 200,000 and significantly outpaced October’s revised gain of 36,000, which had initially been reported as just …

Read More »Oil Prices Slip Amid Concerns Over Supply Surplus Despite OPEC+ Cuts

Oil prices softened on Friday, reflecting persistent market concerns about a looming supply surplus in 2025, even as OPEC+ extended its production cuts through the end of 2026. Brent crude futures dipped by 0.9%, trading at $71.43 per barrel, while US West Texas Intermediate (WTI) fell 1% to $67.65 per …

Read More »US Dollar Marginally Higher Ahead of Jobs Report; Euro Weakens on German Data

The US dollar edged higher on Friday as traders adopted a cautious approach ahead of the release of the US monthly jobs report, while the euro remained under pressure due to weak German industrial data and ongoing political uncertainty in France. At 05:00 ET (10:00 GMT), the Dollar Index, which …

Read More »European Shares Flat Ahead of U.S. Payrolls Data; French Political Developments in Focus

European stock markets showed little movement on Friday, as investors awaited the release of U.S. nonfarm payrolls data, a critical factor in shaping Federal Reserve policy expectations for the coming months. Ongoing political shifts in France and South Korea also remained under watch. Market Highlights: STOXX 600: Down 0.04% by …

Read More »Bitcoin Retreats After Brief Surge Beyond $100,000 Amid Profit-Taking

Bitcoin prices dropped in Asian trading on Friday, reversing gains after a brief rally past the critical $100,000 mark. Profit-taking and investor caution ahead of key U.S. nonfarm payrolls data drove the decline, following optimism over pro-crypto signals from President-elect Donald Trump’s administration. Key Movements: Bitcoin Price: Fell 4.5% to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations