US crude oil futures experienced significant upward momentum, breaking the pivotal resistance level of $68.60 to achieve the anticipated targets from the previous session, reaching $70.50 per barrel. Technical Analysis A closer examination of the 4-hour chart reveals: Support Levels: The price currently holds above minor support at $69.60, with …

Read More »Gold flirts with historic peak 12/12/2024

Gold prices sustained a robust upward trend as anticipated in the previous report, reaching the target of $2720 and recording a peak at $2726 per ounce. Technical Analysis A detailed examination of the 4-hour chart reveals: Positive Signals: The simple moving averages continue to bolster the upward trajectory. The 14-day …

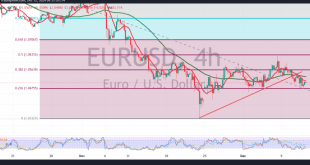

Read More »Euro faces negative pressure ahead of ECB 12/12/2024

The Euro continued its retreat against the US Dollar during the previous session, aligning with the anticipated negative outlook, reaching the first target of 1.0475 and recording a low of 1.0479. Technical Analysis An analysis of the 240-minute chart indicates: Bearish Factors: The simple moving averages are exerting downward pressure. …

Read More »U.S. Consumer Prices Rise Slightly in November, Supporting Expectations for Fed Rate Cut

U.S. consumer prices edged up slightly in November on an annualized basis, aligning with expectations and reinforcing the likelihood of another interest rate cut by the Federal Reserve next week. The Consumer Price Index (CPI) published by the Labor Department rose by 2.7% year-over-year in November, marginally higher than October’s …

Read More »OPEC Cuts Global Oil Demand Growth Forecast for 2024

OPEC announced on Wednesday a reduction in its global oil demand growth forecast for 2024, marking the fifth consecutive downward revision in its monthly report. This adjustment reflects increasing concerns over macroeconomic challenges, including slowing global economic growth, high interest rates, and subdued industrial activity. The group also lowered its …

Read More »US Futures Hold Steady Ahead of Inflation Data; Crude Prices Rise on China Stimulus Hopes

US stock index futures showed little movement early Wednesday, stabilizing after a decline in the previous Wall Street session, as investors await pivotal inflation data. Meanwhile, crude oil prices gained amid expectations of increased demand in China following promises of economic stimulus. Market Snapshot Dow Jones Futures: Down 65 points …

Read More »Bank of Canada Expected to Cut Rates Amid Economic Weakness

The Bank of Canada (BoC) is widely anticipated to reduce its key policy rate by another 50 basis points on Wednesday, marking the second consecutive move of this magnitude. The decision comes as Canada grapples with weak economic growth and rising unemployment, signaling an economy in need of support, according …

Read More »US Dollar Strengthens on Inflation Anticipation; Euro, Sterling, and Yuan Weaken

The U.S. dollar advanced on Wednesday, bolstered by market anticipation ahead of the November consumer inflation report. The greenback’s strength weighed on the euro, sterling, and Chinese yuan, with broader implications for global currency markets. Key Developments Dollar Index Rises At 05:15 ET (10:15 GMT), the Dollar Index climbed 0.3% …

Read More »Oil Prices Edge Higher on China’s Policy Signals and Demand Optimism

Oil prices rose on Wednesday as market optimism grew regarding potential demand recovery in China, the world’s largest crude importer, following Beijing’s announcement of a significant monetary policy shift aimed at spurring economic growth. Market Overview Brent Crude Futures: Up 24 cents (0.3%) to $72.43 a barrel by 0730 GMT. …

Read More »European Markets Rebound in November Amid Style and Sector Shifts

European markets made a recovery in November after initial selloffs following the US elections. However, with the exception of Momentum, factor performance remained subdued. Momentum Style Faces Headwinds Barclays strategists, led by Matthew Joyce, maintained a Neutral stance on Momentum in November, despite its strong post-election performance. This cautious approach …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations