Oil, Crude, trading

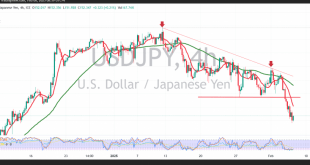

Read More »USD/JPY: Downside pressure persists 6/2/2025

japanese-yen

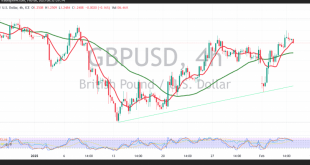

Read More »GBP ahead of USD 6/2/2025

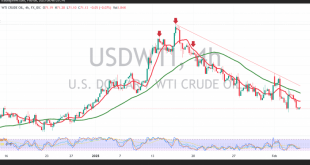

Oil, Crude, trading

Read More »Oil suffers huge losses 6/2/2025

WTI crude oil continues its losing streak for the third consecutive session, now testing the psychological support at $71.00. Technical Outlook: Moving averages exert downward pressure, reinforcing the bearish bias. Price remains below the previously broken support at 72.40, which has now turned into resistance. Key Levels to Watch: Bearish …

Read More »Gold may continue to rise 6/2/2025

Gold prices successfully reached the target of 2870 in the previous session, recording a new high at $2882 per ounce. Technical Outlook: Moving averages continue to support an upward trend. Gold remains within an ascending price channel, with 2840 acting as a key support level. Key Levels to Watch: Bullish …

Read More »Euro may resume temporary rise 6/2/2025

The EUR/USD pair experienced a temporary bullish rebound in the previous session, recovering from the psychological support at 1.0200 and reaching a high of 1.0442. Technical Outlook: The Stochastic indicator is attempting to gain bullish momentum, supporting the possibility of further upside. The pair is holding above the previously breached …

Read More »Uber Shares Drop 6% as Q4 Profit Misses Estimates and Q1 Forecast Disappoints

Uber Technologies (NYSE:UBER) shares fell 6% premarket on Wednesday after reporting a lower-than-expected Q4 profit, with rising costs and a weaker Q1 bookings forecast overshadowing its revenue beat. Q4 Earnings Highlights Revenue: $11.96 billion (beat expectations of $11.77 billion) Adjusted EPS: $0.23 (missed estimates of $0.50) Gross Bookings: $44.2 billion …

Read More »US Stock Futures Fall as Alphabet Earnings Disappoint and Trade Tensions Rise

US stock index futures declined on Wednesday, dragged down by weak earnings from Alphabet and renewed US-China trade tensions. Stock Futures Performance (06:00 ET / 11:00 GMT) Dow Jones Futures: ↓ 80 points (-0.2%) S&P 500 Futures: ↓ 30 points (-0.5%) Nasdaq 100 Futures: ↓ 195 points (-0.9%) On Tuesday, …

Read More »Oil Prices Dip Amid Rising U.S. Stockpiles and Trade War Concerns

Oil prices fell on Wednesday as concerns over rising U.S. crude stockpiles and a potential escalation in the U.S.-China trade war weighed on market sentiment, despite renewed efforts by U.S. President Trump to curb Iranian crude exports. Market Movement Brent crude futures dropped 66 cents (-0.87%) to $75.54 per barrel …

Read More »Apple Faces Antitrust Scrutiny in China Amid Trade Tensions

Apple Inc. (NASDAQ: AAPL) is under review by China’s antitrust watchdog, the State Administration for Market Regulation (SAMR), over its App Store policies and developer fees, according to a Bloomberg report on Wednesday. Key Focus of the Review Regulators are examining Apple’s 30% commission on in-app purchases and its ban …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations