Gold prices surged to a fresh all-time high on Wednesday, extending their third consecutive day of gains amid geopolitical tensions and renewed trade tariff concerns from U.S. President Donald Trump. Spot gold (XAU/USD) climbed above $2,947.08 per ounce during the European trading session. Gold futures also saw strong upward momentum, …

Read More »Oil Prices Climb Amid Supply Disruptions in Russia and the U.S.

Oil prices rose on Wednesday, supported by supply concerns stemming from a Ukrainian drone attack on a Russian oil facility, cold weather disruptions in the U.S., and OPEC+ speculation regarding output levels. Brent crude futures climbed 0.5% to $76.25 per barrel at 07:20 GMT. West Texas Intermediate (WTI) crude for …

Read More »Gold Prices Edge Lower but Stay Near Record Highs Amid Trade Tariff Concerns

Gold prices dipped slightly in Asian trading on Wednesday, with spot gold down 0.2% at $2,929.02 an ounce, while gold futures for April delivery fell 0.1% to $2,946.22 an ounce by 00:27 ET (05:27 GMT). Despite the decline, gold remains near all-time highs, as markets weigh the impact of Trump’s …

Read More »Bitcoin Declines for Fourth Straight Day Amid Trade War Fears and Fed Caution

Bitcoin extended its losing streak on Wednesday, edging 0.4% lower to $95,347.5 by 01:17 ET (6:17 GMT) as investors adopted a cautious stance ahead of potential U.S. trade tariffs and the release of the Federal Reserve’s meeting minutes. Despite the dip, Bitcoin continues to trade within a narrow range, reflecting …

Read More »Oil Prices Rise After Drone Attack on Russian Pipeline, Supply Outlook Limits Gains

Oil prices extended gains on Tuesday following a drone attack on a Russian oil pipeline pumping station, which disrupted crude flows from Kazakhstan. However, expectations of rising supply limited further price increases. Brent crude futures climbed 0.6% to $75.66 per barrel by 10:14 GMT, while U.S. West Texas Intermediate (WTI) …

Read More »Bitcoin Declines Amid Trade Tariff Uncertainty and Fed’s Interest Rate Outlook

Bitcoin edged lower on Tuesday, marking its third consecutive day of declines, as market participants adopted a cautious stance amid ongoing uncertainty surrounding U.S. trade tariffs and the Federal Reserve’s interest rate outlook. The world’s largest cryptocurrency dipped 0.8% to $95,424.7 by 01:14 ET (5:14 GMT). Crypto Investors on Edge: …

Read More »European Markets Trade Higher Amid Geopolitical Tensions

European markets saw modest gains on Tuesday, as investors closely monitored ongoing geopolitical developments. As of 03:08 ET (08:08 GMT), Germany’s DAX rose by 0.1%, the FTSE 100 in the U.K. increased by 0.2%, and France’s CAC 40 edged up by 0.1%. U.S.-Russia Talks Sideline European Involvement Geopolitical tensions remained …

Read More »Gold Holds Strong Despite Dollar Rebound and Trade Uncertainty

Gold prices remained on an upward trajectory in Asian trading on Tuesday, maintaining their strength despite a recent rebound in the U.S. dollar. Uncertainty over trade tariffs and interest rate policies continued to support demand for the precious metal as a safe-haven asset. Market Drivers Gold prices found support from …

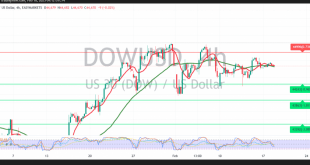

Read More »Dow Jones Seeks Extra Momentum 18/2/2025

Oil, Crude, trading

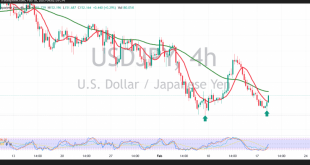

Read More »USD/JPY: Retests Resistance 18/2/2025

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations