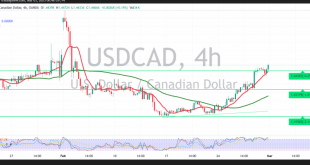

The pair began the week on a bullish note, successfully breaking through the strong resistance level of 1.0450, as highlighted in the previous report. This breakout served as a catalyst for further upside potential, driving the price to a high of 1.0505, with the next target at 1.0540. From a …

Read More »Oil Prices Gain on Strong Chinese Manufacturing Data Amid Geopolitical Uncertainty

Oil prices edged higher on Monday, buoyed by upbeat Chinese manufacturing data, as traders assessed geopolitical developments, including efforts to resolve the Russia-Ukraine conflict and the impact of U.S. tariffs. As of 08:30 ET (13:30 GMT), Brent crude futures for May delivery rose 0.6% to $73.24 per barrel, while West …

Read More »Gold Prices Rise Amid Dollar Weakness and Geopolitical Concerns

Gold prices edged higher in Asian trading on Monday, supported by a weaker U.S. dollar and persistent geopolitical uncertainties. Investors turned to the precious metal as a safe-haven asset amid ongoing trade policy tensions and stalled Russia-Ukraine peace talks. Spot gold increased by 0.3% to $2,865.69 per ounce, while April …

Read More »Bitcoin Surges as Trump Confirms Crypto Strategic Reserve Plans

Bitcoin surged on Monday, extending a sharp rebound from last week’s losses after U.S. President Donald Trump reaffirmed his commitment to establishing a Crypto Strategic Reserve. The move, which includes Bitcoin among other major cryptocurrencies, fueled a rally across digital asset markets. The world’s largest cryptocurrency briefly touched $94,901.96 before …

Read More »European Markets Rise as Investors Await Inflation Data and ECB Policy Decision

European stock markets opened the week on a positive note, with investors closely monitoring upcoming inflation data from the eurozone ahead of the European Central Bank’s (ECB) policy-setting meeting. As of early trading on Monday, Germany’s DAX index advanced by 0.9%, France’s CAC 40 gained 0.2%, and the UK’s FTSE …

Read More »Dow Jones makes significant gains 3/3/2025

Oil, Crude, trading

Read More »CAD breaks through resistance 3/3/2025

The Canadian dollar surged against the U.S. dollar, posting notable gains after successfully rebounding from the support level at 1.4370, reaching a high of 1.4472. From a technical perspective, the 4-hour chart indicates that the simple moving averages continue to provide support from below, reinforcing the potential for further upside. …

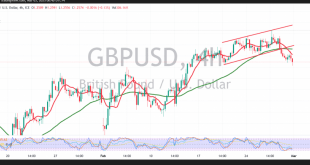

Read More »GBP holds below resistance 3/3/2025

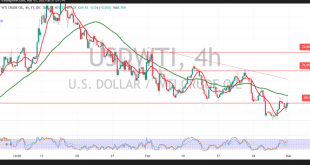

Oil, Crude, trading

Read More »Oil retests resistance 3/3/2025

U.S. crude oil futures attempted to rise, reaching a high of $70.51 per barrel but failed to maintain stability above the key psychological resistance at $70.00. From a technical perspective, the 4-hour chart indicates bearish momentum, as the Relative Strength Index (RSI) remains below the 50 midline, coupled with a …

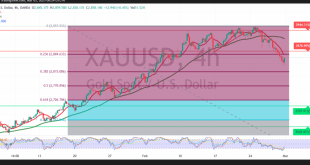

Read More »Gold experiencing negative pressure 3/3/2025

Gold prices suffered heavy losses at the end of last week’s trading amid profit-taking, reaching a low of $2,832 per ounce. From a technical analysis perspective, the 4-hour chart shows clear negative crossover signals on the simple moving averages, reinforced by bearish indications on the 14-day momentum indicator. Given these …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations