After several consecutive sessions of decline, U.S. crude oil futures have staged a bullish rebound, attempting to hold above the psychological barrier of 67.00. Technical Analysis On the 4-hour chart, we maintain a cautiously positive outlook, supported by the Relative Strength Index (RSI) attempting to gain upward momentum and the …

Read More »Gold attacks resistance and needs a positive stimulus 13/3/2025

We previously maintained a neutral stance, emphasizing the need to monitor price behavior around the 2930 resistance level. A confirmed breakout above this level was expected to pave the way for a return to 2940, which was successfully achieved, marking a record high of $2940 per ounce. Technical Analysis On …

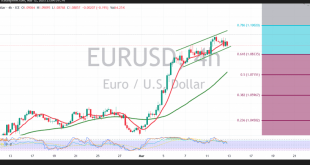

Read More »Euro continues its gradual rise 13/3/2025

The EUR/USD pair successfully reached the first target outlined in the previous technical report at 1.0940, recording a high of 1.0945. Technical Analysis Looking at the 4-hour chart, the pair has established strong support at 1.0830, corresponding to the 61.80% Fibonacci retracement level. Additionally, the Stochastic indicator continues to gain …

Read More »U.S. Inflation Cools in February, Easing Pressure on the Fed

U.S. consumer prices rose at a slower-than-expected pace in February, signaling a potential cooling in inflation that could influence the Federal Reserve’s monetary policy decisions. According to government data released on Wednesday, the headline Consumer Price Index (CPI) increased by 2.8% year-over-year, down from 3.0% in January. On a monthly …

Read More »European Stocks Rise as EU Announces Retaliatory Tariffs on U.S. Imports

European stock markets opened higher on Wednesday as investors reacted to the European Union’s decision to impose retaliatory tariffs on U.S. imports worth up to €26 billion. Market sentiment was also boosted by the U.S. decision to resume intelligence sharing and military aid to Ukraine after Kyiv expressed support for …

Read More »Gold Prices Steady as Markets Await U.S. Inflation Data

Gold prices remained steady in Asian trading on Wednesday, as investors exercised caution ahead of a key U.S. inflation report. The metal continued to find support from its safe-haven appeal amid ongoing volatility surrounding President Donald Trump’s shifting tariff policies. Spot gold held at $2,911.17 per ounce, while gold futures …

Read More »Asian Markets Mixed Amid Tariff Uncertainty and Tech Rebound

Asian equities exhibited a mixed performance on Wednesday, as markets reacted to renewed uncertainty over U.S. President Donald Trump’s shifting trade policies. Losses were led by stocks in Australia and Malaysia, while South Korean shares rebounded, buoyed by modest gains in U.S. tech giants. The backdrop to the market action …

Read More »European Stocks Steady Amid Tariff Concerns and Coalition Uncertainty; Volkswagen Guidance in Focus

European stock markets ended Tuesday on a broadly steady note, largely recovering from Monday’s sell-off that had been driven by fears over the potential impact of U.S. President Donald Trump’s tariff plans on the U.S. economy. The pan-European Stoxx 600 remained mostly unchanged after hitting its lowest level in nearly …

Read More »Gold Supported by Safe-Haven Demand Amid Recession Concerns

Gold prices edged higher in Asian trading on Tuesday as the U.S. dollar weakened to a four-month low amid mounting recession fears driven by President Donald Trump’s trade policies. Investors are now cautiously awaiting the release of U.S. consumer price index (CPI) data scheduled for Wednesday, which could have a …

Read More »Bitcoin Falls Amid Recession Fears and Tariff Risks

Bitcoin fell on Tuesday, briefly hitting a fresh four-month low as investor risk appetite was eroded by mounting concerns over a potential U.S. recession and the uncertainty surrounding further trade tariffs under President Donald Trump. Broader crypto markets also declined, as Trump’s recent announcement of a national crypto stockpile failed …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations