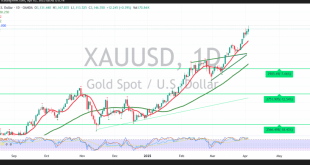

Gold continues its record-breaking rally, reaching $3,167 per ounce during early trading this morning—hitting the official target outlined in the previous technical report. From a technical analysis perspective, the 4-hour chart reflects a strong bullish structure, reinforcing the continuation of the current upward trend. Price action remains comfortably above key …

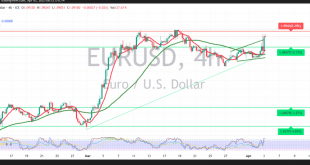

Read More »Euro jumps against USD 3/4/2025

The euro made a notable intraday rally against the US dollar in the previous trading session, reaching a peak of 1.0924. From a technical standpoint, the 4-hour chart shows a bullish signal supported by the 50-period simple moving average, which is acting as a positive catalyst. This comes as the …

Read More »Oil Prices Steady as Markets Await Trump Tariff Announcement

Oil prices held steady on Wednesday, as traders remained cautious ahead of U.S. President Donald Trump’s tariff announcement at 2000 GMT. Concerns over potential trade war escalation and slower global demand for crude kept markets in check. Brent crude futures fell $0.07 (-0.09%) to $74.42 per barrel by 08:58 GMT. …

Read More »Bitcoin Holds Steady Amid Trump Tariff Uncertainty

Bitcoin remained stable on Wednesday, with little buying interest as investors stayed risk-averse ahead of U.S. President Donald Trump’s trade tariff announcement. The world’s largest cryptocurrency has shown a marginal recovery this week after suffering sharp losses in Q1 2025. However, the rebound remains fragile amid economic turbulence under Trump’s …

Read More »Dollar Inches Higher as Markets Brace for Trump’s Trade Tariff Announcement

The U.S. dollar edged up slightly on Wednesday, while other major currencies remained within tight ranges, as traders awaited details of President Donald Trump’s tariff plans. These measures, set to be unveiled in a White House Rose Garden announcement at 20:00 GMT, could disrupt global trade flows and heighten financial …

Read More »European Stocks Decline as Investors Await Clarity on Trump’s Tariffs

European equity markets opened lower on Wednesday, as investors remained cautious ahead of the anticipated tariff announcement by the Trump administration. Markets are seeking more clarity on the scale and impact of the proposed trade barriers, which could significantly affect global trade and economic growth. European Markets at a Glance …

Read More »Gold Eases from Record High as Markets Await Trump’s Tariff Details

Gold prices edged lower in Asian trading on Wednesday, retreating slightly after hitting an all-time high in the previous session, as traders remained cautious ahead of U.S. President Donald Trump’s April 2 tariff announcements. Gold Market Performance Spot gold (XAU/USD) fell 0.3% to $3,116.24 per ounce by 00:57 ET (04:57 …

Read More »Dollar Holds Steady as Markets Await Trump’s Reciprocal Tariffs

The U.S. dollar remained stable on Tuesday as investors prepared for new reciprocal tariffs set to be announced by President Donald Trump on Wednesday. Market Focus on U.S. Economic Data Investors are closely watching the U.S. Job Openings and Labor Turnover Survey (JOLTS) and the ISM Manufacturing Index, both due …

Read More »U.S. Stock Futures Steady as Investors Weigh Recession Risks Ahead of Tariff Announcements

Wall Street index futures traded in tight ranges on Tuesday, stabilizing after a turbulent first quarter, as investors assessed the potential impact of upcoming trade tariffs from U.S. President Donald Trump. Stock Futures Movement Dow Jones Futures fell 60 points (-0.1%). S&P 500 Futures traded flat. Nasdaq 100 Futures gained …

Read More »Gold Hits New Record High Amid Market Uncertainty Over U.S. Tariffs

Gold prices surged to an all-time high in Asian trading on Tuesday, driven by rising safe-haven demand as investors braced for upcoming tariff announcements from U.S. President Donald Trump. Gold’s Record-Breaking Rally Spot Gold rose 0.7% to $3,148.10 per ounce, marking its highest level ever. Gold Futures (June) gained 0.3% …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations