Bitcoin continued its upward march on Monday, climbing 1.4% to $104,815.5 by 02:51 GMT, after briefly breaching $107,000 earlier in the session. The token is now trading at its highest level since January 2025, just shy of its all-time high of $109,228, as a confluence of macroeconomic tailwinds and investor …

Read More »European Stocks Slip as Markets Eye UK-EU Summit, Ukraine Talks and Final EU Inflation Data

European equity indices opened slightly lower on Monday, as investors took a cautious approach to start the week amid key geopolitical developments and the release of eurozone inflation data. By 03:05 ET (07:05 GMT), the DAX index in Germany was down 0.1%, France’s CAC 40 lost 0.4%, and the FTSE …

Read More »Gold Prices Rise as Moody’s U.S. Downgrade Reignites Safe-Haven Demand

Gold prices climbed on Monday, supported by a resurgence in safe-haven demand after ratings agency Moody’s downgraded the U.S. sovereign credit rating, triggering risk aversion across global markets. Mixed Chinese economic data added to market caution, bolstering bullion’s appeal further. As of 01:51 ET (05:51 GMT), spot gold rose 0.5% …

Read More »Oil Prices Slip Amid U.S. Credit Downgrade and China Growth Concerns

Oil prices fell slightly on Monday, pressured by Moody’s downgrade of the U.S. sovereign credit rating and signs of a cooling economic recovery in China, the world’s largest crude importer. As of 04:40 GMT, Brent crude futures for front-month delivery dropped 35 cents, or 0.5%, to $65.06 per barrel, while …

Read More »U.S. Futures Tick Higher as Rate Cut Bets Firm, Barclays Scraps Recession Call

U.S. stock index futures edged higher in early Friday trading, stabilizing after a mixed performance on Wall Street, as investors weighed a run of soft economic data that bolstered expectations for interest rate cuts later this year. At 05:35 ET (09:35 GMT), Dow Jones Futures rose 90 points, or 0.2%, …

Read More »Gold Heads for Worst Week Since November as Trade Truce Dulls Safe-Haven Appeal

Gold prices declined in Asian trading on Friday, poised for their steepest weekly drop in over six months, as signs of easing trade tensions between the United States and China dampened investor appetite for safe-haven assets. Spot gold fell 0.8% to $3,214.90 an ounce, while gold futures for June delivery …

Read More »Dow Jones Shows Signs of Recovery 16/5/2025

Oil, Crude, trading

Read More »CAD Needs a Positive Catalyst 16/5/2025

The Canadian dollar has resumed an upward corrective trend after establishing a solid support base The Canadian dollar met its initial upside target at 1.4000, with the pair registering a session high of 1.4004 during the previous trading session. From a technical perspective, the 1.4000 psychological resistance level has exerted …

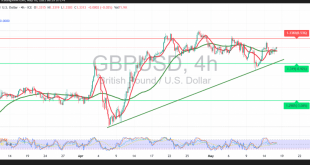

Read More »GBP Attempts a Gradual Recovery 16/5/2025

Oil, Crude, trading

Read More »Oil Traders Should Monitor Price Behavior Closely 16/5/2025

U.S. crude oil futures aligned with the expected upward movement in the previous session, as the price held above the pivotal $61.20 support level. Although the market briefly dipped to $60.11, triggering a pullback that offset earlier long positions, the broader technical structure remains constructive. On the 4-hour chart, the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations