Positive trading has returned to the Canadian dollar after it found solid demand near the psychological barrier of 1.3800, sparking a modest upward bounce. From a technical perspective, the 4-hour chart shows the pair attempting to shake off the negative pressure stemming from overbought conditions, while the simple moving averages …

Read More »GBP Pressures Support 29/5/2025

Oil, Crude, trading

Read More »Oil Holds Above the Support Line 29/5/2025

US crude oil futures reversed the expected downward trend outlined in the previous technical report, which was based on trading stability below the key resistance level at $61.90. Instead, the market shifted to a more positive tone, with intraday movements showing a clear upside bias. Prices are currently hovering near …

Read More »Gold starts negatively 29/5/2025

Gold prices achieved the first upside target at $3,311 at the start of the European trading session, reaching a high of $3,325, though gains remained modest. As highlighted in the previous report, price consolidation at $3,270 was expected to halt the bullish momentum and apply negative pressure, potentially triggering a …

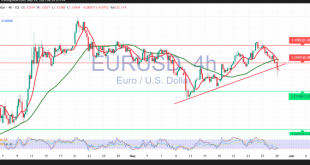

Read More »Euro Breaks Below Key Support Level 29/5/2025

The euro weakened against the U.S. dollar in the previous session after encountering strong resistance at 1.1350, aligning with the target highlighted in the previous report. The pair recorded a session high of 1.1345 before retreating sharply. As expected, an hourly candle close below 1.1270 has postponed the upside potential, …

Read More »OPEC+ to Discuss 2027 Production Baselines and Potential July Output Hike

OPEC+ is set to hold a key meeting on Wednesday to deliberate on long-term production baselines for 2027, as the group navigates internal differences over quotas, according to Reuters, citing two delegates familiar with the matter. A separate meeting on Saturday may result in a decision to accelerate oil output …

Read More »U.S. Stock Futures Steady as Nvidia Earnings Awaited; Tariff Truce Boosts Sentiment

U.S. stock index futures hovered near flat in early Wednesday trading, as investors caught their breath following a robust rally sparked by easing tariff tensions. Market focus has now shifted to the upcoming earnings release from chipmaker Nvidia (NASDAQ:NVDA) and fresh updates on global trade policy. At 06:42 a.m. ET, …

Read More »German Unemployment Rises Sharply, Exposing Strain on Economy

Germany’s job market took a heavier hit than expected in May, with the number of unemployed rising by 34,000 to 2.96 million in seasonally adjusted terms, data from the Federal Labour Office showed Wednesday. The increase far exceeded analyst expectations of a 10,000 rise and pushed the unemployment rate closer …

Read More »Gold Prices Slip as Risk Appetite Improves, Dollar Recovers

Gold prices edged lower in Asian trading on Wednesday, weighed down by a revival in risk appetite after U.S. President Donald Trump delayed plans to impose steep tariffs on the European Union. The move, which helped lift equity markets and investor sentiment, reduced demand for safe-haven assets like gold. Spot …

Read More »Oil Prices Climb on Russia Sanction Risks, Venezuela Export Ban, and Caution Ahead of OPEC+ Meeting

Oil prices rose in Asian trade on Wednesday, supported by growing concerns over potential new sanctions on Russia and disruptions in Venezuelan crude flows, alongside uncertainty ahead of a crucial OPEC+ meeting later this week. As of 21:28 ET (01:28 GMT), Brent crude futures for July delivery climbed 0.7% to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations