Gold prices saw a sharp rise in Asian trading on Thursday, as safe-haven demand surged due to escalating concerns over potential military action with Iran and a risk-averse reaction to President Donald Trump’s comments on trade tariffs. Spot gold rose 0.6% to $3,374.94 per ounce, while gold futures for August …

Read More »Dow Jones Faces Selling Pressure 12/6/2025

Oil, Crude, trading

Read More »CAD Continues to Slide Further 12/6/2025

The Canadian dollar continued its decline against the U.S. dollar within the expected bearish trend, reaching the first target of 1.3650 outlined in the previous technical report, with the pair recording a session low of 1.3648. From a technical standpoint, the 4-hour chart confirms the persistence of downside pressure. The …

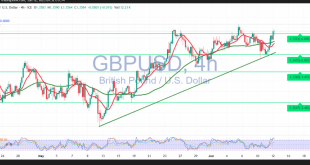

Read More »GBP hovers around pivotal resistance 12/6/2025

Oil, Crude, trading

Read More »Oil May Undergo Overbought Correction 12/6/2025

U.S. crude oil futures posted sharp gains in the previous session, reaching the official target of $66.85 and extending to a session high of $68.98 per barrel. From a technical standpoint, intraday price action showed signs of bearish pressure, largely attributed to profit-taking after the strong rally. This coincides with …

Read More »Gold Attempts to Regain Its Uptrend 12/6/2025

Gold prices exhibited mixed behavior during recent sessions, initially continuing the expected corrective decline and approaching the first downside target of $3,312, as highlighted in the previous technical report. The metal recorded a low of $3,315 before reversing course, driven by a sharp rebound following the release of U.S. inflation …

Read More »Euro Reaches Target Levels 12/6/2025

The EUR/USD pair maintained its upward momentum, aligning with the previously anticipated positive outlook. The pair successfully reached the official target of 1.1520, posting a session high of 1.1529. From a technical standpoint, the bullish trend remains intact, supported by price stability above the simple moving averages, which continue to …

Read More »U.S. Inflation Slows Slightly in May, Misses Expectations and Pressures Dollar

Inflation in the United States, as measured by the Consumer Price Index (CPI), rose to 2.4% year-over-year in May, up slightly from 2.3% in April, according to data released Wednesday by the U.S. Bureau of Labor Statistics (BLS). However, the figure came in just below market expectations of 2.5%. Core …

Read More »Wall Street Futures Edge Lower as Investors Await Key U.S. CPI Report and Scrutinize U.S.-China Trade Framework

U.S. stock index futures edged slightly lower early Wednesday, as investor enthusiasm over a newly proposed U.S.-China trade framework faded and attention shifted to critical U.S. inflation data due later in the day. As of 05:40 ET (09:40 GMT): Dow Jones Futures dropped 50 points (−0.1%) S&P 500 Futures fell …

Read More »Bitcoin Holds Steady as Markets Await Details on U.S.-China Trade Framework and U.S. CPI Data

Bitcoin traded largely flat on Wednesday, pausing after Tuesday’s sharp gains as traders digested news of a proposed U.S.-China trade framework and awaited more clarity on both the deal and upcoming U.S. inflation data. As of 02:08 ET (06:08 GMT), Bitcoin remained unchanged at $109,559.20, hovering just below the record …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations