The US State Department said that most of those who applied for US visas and were rejected due to Trump’s decision to ban entry to citizens of 13 countries can seek to reconsider their applications or apply for new ones. President Joe Biden canceled the ban on entry to certain …

Read More »Oil Prices Declining After Jumping Above $70 a Barrel Following Attack on oil facilities in Saudi Arabia

Oil prices retreated on Monday after jumping earlier in the session above $70 a barrel for the first time since the start of the Coronavirus crisis, following attacks on Saudi oil facilities. Brent crude futures, the world record, ended the trading session down $1.12, or the equivalent of 1.61%, to …

Read More »Investor Confidence Jumping to a Year High in Eurozone

Today’s survey showed that an indicator of investor confidence in the eurozone jumped in March to its highest reading in more than a year, supported by an improved outlook for the current situation. The Sentex Eurozone index rose to 5.0 from -0.2 in February, its highest level since February 2020. …

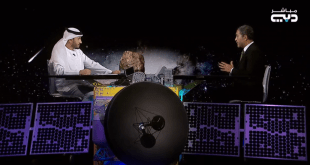

Read More »Dubai TV Interview, March 8, 2021

In an interview with Dubai TV, Director of Research and Development at Noor Capital, Mohamed Hashad takes a closer look at the markets. Oil Purchasing biases pushed crude oil prices to touch the highest level since October 2018, and we can say that the biggest supporter of the rise in …

Read More »Dubai TV Interview, March 8, 2021

In an interview with Dubai TV, Director of Research and Development at Noor Capital, Mohamed Hashad takes a closer look at the markets. Oil Purchasing biases pushed crude oil prices to touch the highest level since October 2018, and we can say that the biggest supporter of the rise in …

Read More »Fall of The Turkish Lira Over Two-Week

The Turkish lira fell 0.7% today, recording a decline in ten of the last eleven sessions, with high inflation, global bond yields and oil prices in a test of the central bank’s pledge to tighten monetary policy. After raising interest rates to 17% in December, Central Bank Governor Naji Iqbal …

Read More »Oil And Travel Support European Stocks

European stocks rose today to coincide with the rise of the US market at the end of trading on Friday, as shares of major oil companies such as Royal Dutch Shell and BP jumped with the rise in crude prices after reports of attacks on facilities in Saudi Arabia. The …

Read More »Brent Exceeds $70 For The First Time Since The Pandemic

Brent crude futures rose above $70 a barrel today, Monday, for the first time since the outbreak of the Covid-19 pandemic, while US crude touched its highest level in more than two years, following reports of attacks on Saudi facilities. Brent contracts for May delivery reached $71.38 a barrel in …

Read More »German Industrial Output Unexpectedly Declined in January

German industrial output fell unexpectedly in January, following a significant increase in the previous month’s reading, data released on Monday showed, predicting a weak start to the year for the manufacturing sector in Europe’s largest economy. Figures released by the Federal Statistics Office show a decline in output in the …

Read More »Gold is Recovering From Its 9-Month Low on The US Stimulus And Falling Bond Yields

Gold rebounded today from its lowest level in nine months recorded last week, with the decline in bond yields and the approval of a huge US stimulus package to increase the attractiveness of the metal as a hedging tool in the face of inflation. Gold rose in the spot market …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations