European stocks rose today on the back of gains from French food company Danone and Swiss pharmaceutical company Roche, with optimism about a strong economic recovery easing concerns about an acceleration in inflation. The STOXX 600 index rose 0.7% in early trade, slightly close to its highest level last year, …

Read More »Italy Announces a Plan to Vaccinate at Least 80% of The Population Against Corona by September

Italy said on Saturday it aims to vaccinate at least 80% of its population against COVID-19 by September by ramping up its daily vaccination campaign. Francesco Paolo Vignolo, the new special commissioner for the Coronavirus, announced a general plan to distribute 500,000 vaccine doses per day, according to a statement …

Read More »Turkish Car Production Drops 9% in February

The Turkish Automobile Industry Federation said that the country’s auto sector production fell 9.3% year-on-year in February to 116,88 cars, and exports fell 14.3% to 87,908 cars. said that in the period from January to February, production decreased 6.5 percent to 222,264 cars, while exports decreased 14.1.

Read More »Brent Crude Heading to $70 as The Outlook For Chinese Energy Demand Improves

Oil prices rose today, and Brent is heading towards the level of seventy dollars a barrel, as data show the acceleration of the Chinese economic recovery at the beginning of 2021, which supports the energy demand of the largest importer of oil in the world. Brent crude for May delivery …

Read More »Gold Gives up Gains Amid Hopes of a Quick Recovery After Chinese Data

Gold prices erased their early gains today, as hopes for a faster economic recovery were supported by better-than-expected Chinese industrial production data, and pressure continued on the metal due to high US bond yields. There was little change in the price of gold in the spot market at $1724.68 an …

Read More »Japan Shares Closed Higher, Posting 3% Weekly Gain

Japanese stocks rose on Monday thanks to the optimism that accompanied the approval of a huge US stimulus package to support stocks linked to the economic cycle, while SoftBank Group shares fell, while other technology companies recorded limited gains. The Nikkei index rose 0.17% to close at 29,766.97 points, and …

Read More »German DAX Maintains Bullish Path

The German DAX index maintains positive stability, recording its highest level during early trading for the current session 14,561. Technically, we tend to be positive in our trades depending on the positive motive coming from the 50-day moving average, in addition to trading stability above the support level of 14,480 …

Read More »Dow Jones Continues to Maximize Gains

The Dow Jones Industrial Average on Wall Street jumped within the expected upward trend during the previous analysis, touching the first target to be achieved at 32,680, heading towards the official target station of 32,820, recording a high of 32,840. On the technical side, today, we hold onto our positive …

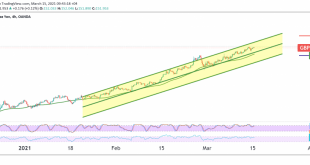

Read More »GBP/JPY: Attacks Resistance

The pound maintained positive stability against its Japanese counterpart, after finding a good support floor near the level of 151.20. On the technical side today, and with a closer look at the chart, we find the 50-day moving average is still providing a positive motive, accompanied by the stability of …

Read More »Canadian Dollar Continues to Achieve The Descending Targets

The Canadian dollar incurred noticeable losses within the expected downside path, touching the first official leg targeted during the last analysis, at a price of 1.2460, recording its lowest level at 1.2455. Technically speaking, and with a closer look at the 4-hour interval, and with the continued negative pressure coming …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations