Gold prices experienced significant volatility during yesterday’s session, following the release of U.S. inflation data that strengthened the dollar and exerted downward pressure on gold. As noted in our previous report, a break below $3,340 reactivated the bearish scenario, which materialized after gold dipped to $3,320. Technical Outlook – 4-Hour …

Read More »Strong Greenback Derails Euro’s Recovery Efforts 16/7/2025

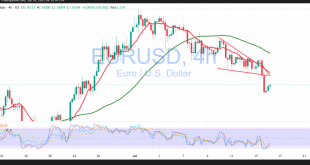

The EUR/USD pair extended its decline in the previous trading session, in line with the bearish outlook outlined in the prior technical report. The pair reached the expected target at 1.1610, recording a session low of 1.1593. Technical Outlook – 4-Hour Timeframe: Intraday price action reflects attempts at recovery driven …

Read More »Wells Fargo Beats Q2 Profit Estimates but Cuts 2025 NII Forecast

Wells Fargo reported strong second-quarter earnings, surpassing analysts’ profit estimates, but cut its 2025 net interest income (NII) guidance, leading to a 3% drop in shares in pre-market trading. Key Highlights: Net Income: Wells Fargo posted $5.49 billion ($1.60 per share), up from $4.91 billion ($1.33 per share) a year …

Read More »U.S. Inflation Rises to 2.7% in June

The U.S. inflation rate reached 2.7% in June, according to the Consumer Price Index (CPI) report released by the U.S. Bureau of Labor Statistics (BLS) on Tuesday. This marks an increase from May’s inflation rate of 2.4% and aligns with market expectations. Key Data: The headline CPI rose 2.7% year-on-year, …

Read More »Citigroup Reports Strong Q2 Profit Surge Amid Volatile Markets

Citigroup (NYSE: C) posted a significant 25% year-on-year rise in net income for the second quarter, driven by windfall earnings from volatile markets. The bank’s net income reached $4 billion, or $1.96 per share, for the three months ending June 30. Key Financial Metrics: Revenue increased by 8% to $21.7 …

Read More »JPMorgan Chase Reports Decline in Q2 Revenue and Income but Tops Expectations

JPMorgan Chase (NYSE: JPM) reported a decline in second-quarter net revenue and net income but managed to beat analyst expectations, driven by strong performance in markets and investment banking, despite ongoing trade tensions and tariff-driven volatility. Key Financial Metrics: Net revenue fell by 10% to $45.7 billion, surpassing analysts’ expectations …

Read More »Gold Prices Rise Amid Trade and Geopolitical Tensions

Gold prices saw an uptick in Asian trade on Tuesday, as ongoing concerns over U.S. President Donald Trump’s trade tariffs and geopolitical tensions contributed to sustained demand for safe-haven assets. Gold and Geopolitical Factors: Spot gold rose by 0.6%, reaching $3,364.26 an ounce. Gold futures for September increased by 0.4%, …

Read More »Dow Jones Rises Steadily as Markets Await Inflation Data 15/7/2025

Oil, Crude, trading

Read More »CAD Maintains Bullish Technical Momentum 15/7/2025

The pair continues to benefit from the support of the 50-period Simple Moving Average (SMA), which reinforces short-term bullish momentum. This is further supported by a notable improvement in momentum indicators, with the Relative Strength Index (RSI) generating constructive signals that favor the continuation of the uptrend in the near …

Read More »Greenback Pressure Drives the Pound Lower 15/7/2025

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations