U.S. stocks saw a slight rise on Friday as investors digested positive second-quarter earnings reports and signs of a resilient economy, despite lingering tariff uncertainties. By 09:32 ET (13:32 GMT), the Dow Jones Industrial Average gained 85 points or 0.2%, the S&P 500 index rose 12 points or 0.2%, and …

Read More »Oil Prices Surge Amid Drone Attacks and New EU Sanctions on Russia

Oil prices saw a notable increase on Friday, extending the sharp gains from the previous session, driven by drone attacks on Iraqi oil fields and fresh sanctions from the European Union (EU) on Russia. As of 08:10 ET (12:10 GMT), Brent Oil Futures for September delivery rose 1.6% to $70.60 …

Read More »Bitcoin Reaches $120,000 as U.S. House Passes Landmark Crypto Bills

Bitcoin surged above $120,000 in Asian trade on Friday, continuing its impressive rally and heading for its fourth consecutive weekly gain. The latest push was driven by optimism surrounding U.S. cryptocurrency legislation, with the U.S. House of Representatives clearing three bills aimed at establishing a clearer regulatory framework for digital …

Read More »European Stocks Rise Amid Strong Earnings and Positive Wall Street Lead

European stocks rose on Friday, buoyed by a positive overnight performance on Wall Street, as investors digested a wave of favorable quarterly earnings reports. The DAX index in Germany climbed 0.5%, the CAC 40 in France gained 0.6%, and the FTSE 100 in the UK rose 0.2% at 03:05 ET …

Read More »U.S. Dollar Strengthens Amid Solid Economic Data, While Euro and Pound Struggle

The U.S. dollar continues to show strength, rising for the second consecutive week, supported by robust U.S. economic data. Despite a 0.4% dip on Friday to 98.100, the dollar is poised for a weekly gain of 0.7%, continuing its bullish momentum from last week’s 1% rise. The positive economic outlook …

Read More »Dow Jones Posts Notable Gains 18/7/2025

DowJones

Read More »CAD Trades Above Key Support: Are Further Gains Likely? 18/7/2025

The Canadian dollar continued its upward trajectory, achieving the expected positive targets outlined in the previous technical report. The pair reached the 1.3770 target and extended to a new high of 1.3774. Technical Outlook – 4-Hour Timeframe: Price action reflects ongoing bullish momentum, supported by the pair’s stability above the …

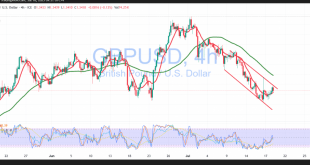

Read More »GBP Tries to Rebound Despite Continued Bearish Signals 18/7/2025

Oil, Crude, trading

Read More »Gold holds above key support amid technical upside attempts 18/7/2025

Gold prices exhibited mixed but upward-biased movement, with the metal maintaining its position above the pivotal support area at $3,310, preserving a positive short-term outlook. Technical Outlook – 4-Hour Timeframe: Intraday price action reflects a continuation of the bullish trend, following a solid bounce from $3,310. This support level allowed …

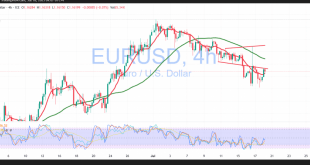

Read More »Euro’s Rebound Attempts Remain Limited Amid Dollar Strength 18/7/2025

As highlighted in the previous technical report, the EUR/USD pair successfully reached the bearish target at 1.1575, recording a session low of 1.1557. Technical Outlook – 4-Hour Timeframe: Intraday movements indicate limited rebound attempts, following a temporary halt in selling pressure at the 1.1575 support level. The pair is currently …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations