Manufacturing and Services Performances Diverge as Economic Outlook Remains Mixed Germany’s business activity continued to show marginal growth in July, though at a slightly slower pace compared to June, according to the latest HCOB German flash composite Purchasing Managers’ Index (PMI). The index, compiled by S&P Global, dropped to 50.3 …

Read More »France’s Private Sector Activity Contracts for 11th Consecutive Month Amid Political Uncertainty

July Data Shows Limited Growth in France’s Private Sector, Reflecting Weak Demand and Business Confidence France’s private sector activity continued to contract in July, marking the 11th consecutive month of shrinkage, according to the latest S&P Global data. This prolonged downturn highlights the persistent challenges facing the eurozone’s second-largest economy, …

Read More »Gold Prices Fall as U.S.-Japan Trade Deal and Tech Earnings Boost Risk Appetite

Gold prices dipped on Thursday, continuing a downward trend following recent highs, as a U.S.-Japan trade deal and strong earnings from tech companies boosted risk appetite, reducing demand for safe-haven assets like gold. Market Overview: Spot gold dropped 0.3% to $3,378.93 an ounce. Gold futures fell 0.4% to $3,384.60/oz. Despite …

Read More »Oil Prices Edge Higher Amid U.S. Crude Stock Decline and Trade Deal Optimism

Oil prices inched higher during Asian trading on Thursday, with data showing a significant drop in U.S. crude stockpiles providing some support, although concerns over U.S. tariffs and trade negotiations ahead of President Donald Trump’s deadline kept investors cautious. Market Overview: Brent Oil Futures for September rose 0.3% to $68.69 …

Read More »Wall Street Set for Stronger Opening on U.S.-Japan Trade Deal, Earnings Reports in Focus

Wall Street is set to open on a positive note on Wednesday after President Donald Trump announced a trade agreement with Japan, boosting expectations of further trade deals ahead of the August 1 deadline for U.S. tariffs. U.S.-Japan Trade Deal Boosts Market Sentiment The U.S.-Japan trade deal, which slashes tariffs …

Read More »Oil Prices Steady After U.S.-Japan Trade Deal Boosts Global Trade Sentiment

Oil prices were relatively stable on Wednesday following three consecutive days of losses, with a boost from a U.S.-Japan trade agreement that raised optimism for global trade. Price Movements and Market Sentiment As of 0907 GMT, Brent crude futures were down 12 cents, or 0.2%, to $68.47 per barrel, while …

Read More »Bitcoin Edges Higher Amid U.S.-Japan Trade Deal, But Consolidation Persists

Bitcoin traded slightly higher on Wednesday, continuing its recent consolidation phase after surging to record highs earlier this month. The world’s largest cryptocurrency rose by 0.5%, reaching $118,582.7 as of 02:10 ET (06:10 GMT). Bitcoin’s Rangebound Trading Amid Broader Market Sentiment Bitcoin has been trading within a narrow range since …

Read More »European Stocks Rally as Hopes for EU-U.S. Trade Deal Rise

European shares climbed on Wednesday, buoyed by renewed optimism for a potential trade deal between the U.S. and the European Union (EU) following U.S. President Donald Trump’s recent trade agreement with Japan. The broad rally was led by the automotive sector, which saw significant gains in light of favorable trade …

Read More »Gold Prices Dip as U.S.-Japan Trade Deal Eases Risk Concerns, But Market Uncertainty Persists

Gold prices experienced a slight pullback on Wednesday, retreating marginally from the strong gains seen earlier this week. The dip was influenced by the announcement of a trade deal between the U.S. and Japan, which helped boost risk appetite and dampened the demand for safe-haven assets like gold. At 01:20 …

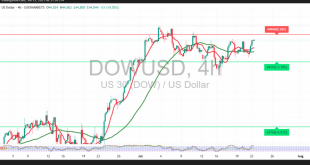

Read More »Wall Street Cheers Dow Rally — Eyes Now on the 45,000 Mark! 23/7/2025

DowJones

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations