European shares fell in early trading after gains over three sessions, as a jump in commodity shares was offset by weak trading in Asia and a sudden drop in industrial orders in Germany. The pan-European Stoxx 600 index fell 0.1%, with auto stocks recording the biggest decline. Data showed that …

Read More »DAX Under Selling Pressure

Mixed trading tends to negatively dominate the movements of the German DAX traded on the Frankfurt Stock Exchange, with the current moves witnessing a bearish tendency as a result of the index’s failure to maintain trading above 15680. We may witness a bearish bias in the coming hours as the …

Read More »Japan’s Nikkei Rises With SoftBank’s Recovery

The Nikkei index closed slightly higher on the Tokyo Stock Exchange on Tuesday, with the recovery of SoftBank and Fast Retailing shares, but fears of a possible increase in Coronavirus infections during the Olympic Games capped gains. The Nikkei gained 0.16 percent to record 28,643.21 points, giving up an early …

Read More »Dow Jones Keeps Bullish Tone

Oil, Crude, trading

Read More »GBP/JPY Finds Support, Extends Gains

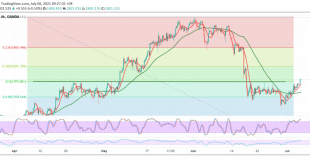

GBP/JPY traded positively after finding good support around 153.00. The technical picture is positive due to intraday trading stability above 153.40, always on the back of positive stimulus from the 50-day moving average, which cushions the price from the downside. Therefore, we target 154.10 as the first target. Breaking through …

Read More »CAD Facing Downward Pressure

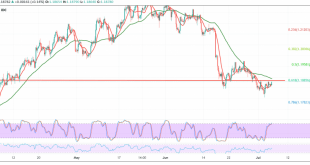

The Canadian dollar intraday movements witnessed a modest bearish bias after several consecutive sessions of ascending within the bullish correction, which touched 1.2410. Technically, the current trading is stable intraday below the resistance level of 1.2330/1.2340, 50.0% Fibonacci level, with the simple moving averages pressuring the price from above. Therefore, …

Read More »Sterling Kicks Off on a Positive Note

Oil, Crude, trading

Read More »Crude Oil Prices Keep Rallying

Oil, Crude, trading

Read More »Gold Attacks Resistance, Risk-on mood

Positive trading dominated gold’s movements during the early trading of the ongoing session, attacking the resistance level of 1800, a psychological barrier, to reach the top of 1802. Today’s technical analysis indicates the possibility of continuing the rise, with the price breaking through the 1797 resistance level, 50.0% correction, in …

Read More »The Euro Hovers around Resistance Levels

The single European currency kicked off the weekly trading on a slightly bullish slope, aiming to retest the resistance level 1.1880/1.1890. Technically speaking, the 4-hour chart shows that the stochastic is trading around overbought levels, with trading stabilized below the 1.1880/1.1890 resistance level, 61.80% Fibonacci level. Therefore, the bearish scenario …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations