Gold is making limited attempts to recover recent losses; however, these efforts are currently facing strong technical resistance near the $3,315 per ounce level. Technical Outlook: The price is consolidating just below this key resistance area. On the chart, the 50-period Simple Moving Average (SMA) and shorter moving averages continue …

Read More »EUR Approaches First Key Support Level: Can It Withstand the Pressure? 1/8/2025

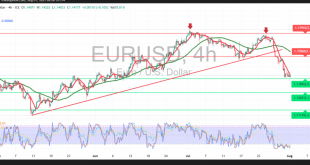

The EUR/USD pair traded within a bearish sideways range during the previous session, maintaining alignment with the prevailing negative outlook. The pair approached the key psychological barrier at 1.1400, recording its lowest level near that threshold. Technical Outlook: Currently, the pair is attempting a limited rebound to recover part of …

Read More »U.S. Unemployment Claims Rise to 218K for the Week Ending July 26

According to the latest U.S. Department of Labor (DOL) report released on Thursday, the number of new unemployment insurance applications in the United States rose to 218,000 for the week ending July 26, slightly above the previous week’s figure of 217,000. The print came in below market expectations of 224,000. …

Read More »U.S. Annual Inflation Rises to 2.6% in June, Exceeding Expectations

Annual inflation in the United States as measured by the Personal Consumption Expenditures (PCE) Price Index rose to 2.6% in June, up from 2.4% in May (revised from 2.3%), according to the U.S. Bureau of Economic Analysis data released on Thursday. Inflation Increase: The inflation rate for June surpassed the …

Read More »Bitcoin Struggles to Gain Momentum as Fed Holds Rates and Trade Tariff Deadline Approaches

Bitcoin remained largely unchanged on Thursday, maintaining its rangebound movement after the Federal Reserve’s decision to keep interest rates steady, which dampened risk appetite. The focus has shifted to the upcoming U.S. trade tariff deadline. Key Highlights: Bitcoin’s Steady Movement: Bitcoin rose 0.4% to $118,503.1, but remained below the $120,000 …

Read More »Shell Reports 32% Drop in Q2 Profit Amidst Lower Oil Prices and Chemicals Losses, But Beats Forecasts

Shell’s second-quarter net profit plunged by almost 32% on Thursday, impacted by a drop in oil prices, weaker gas trading results, and losses linked to an outage in its chemicals operations. However, despite these challenges, the oil major exceeded analysts’ expectations with a reported $4.26 billion in adjusted earnings, significantly …

Read More »Microsoft Poised to Surpass $4 Trillion Market Valuation on Investor Confidence in Azure

Microsoft is set to make history on Thursday by surpassing a $4 trillion market valuation for the first time, propelled by investor confidence in its Azure cloud division. The tech giant’s stock surged by 8.6%, reaching $557.34 per share in early premarket trading, pushing its total valuation to $4.14 trillion. …

Read More »Gold Prices Rebound Amid Trade Tariff Jitters, Fed’s Stance Limits Gains

Gold prices rebounded from one-month lows in Asian trade on Thursday, as escalating trade tariff concerns ahead of President Donald Trump’s looming deadline increased demand for safe-haven assets like gold. Gold Price Movements: Spot Gold rose 0.8% to $3,301.21 an ounce, marking a recovery after a recent dip. Gold Futures …

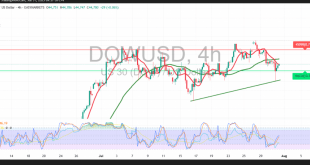

Read More »Mixed Movements for Dow Jones — Support at 44,485 Under Watch 31/7/2025

DowJones

Read More »Canadian Dollar Continues Its Gradual Rise 31/7/2025

The USD/CAD pair continued to follow the bullish outlook highlighted in our previous report, successfully reaching the official target of 1.3840 and recording a session high of 1.3845. Technical Outlook: The pair maintains a strong upward trajectory, supported by continued price stability above key Simple Moving Averages (SMAs), which act …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations