Oil, Crude, trading

Read More »GBP/JPY: Maintains Bullish Trend

The USD/JPY was little changed, and the technical outlook remained the same, within a tendency to rise, recording its highest level at 154.22. On the technical side, we are inclined to the positivity, based on stability and intraday stability above the support level of 153.40, in addition to the clear …

Read More »The Canadian Dollar Around Targets

The Canadian dollar could trade within the bullish correction tendency indicated during the past weeks, recording the highest level at 12745. However, the intraday movements are witnessing temporary adverse movements that hit the resistance level 1.2730 23.60% correction. Technically, and carefully looking at the 4-hour chart, we notice that the …

Read More »The British Pound is Heading Down

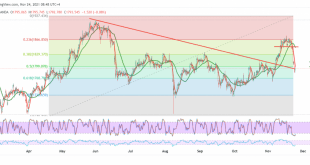

Oil, Crude, trading

Read More »Oil Trims its Losses

Oil, Crude, trading

Read More »Gold Extends Losses

Gold prices continued the negative move within the strong profit-taking wave that started with the beginning of last week’s trading, explaining that the stability of trading below the 1799 support level, opening the door to visit the target of 1769, posting a low at 1781. Technically, we notice the price …

Read More »Euro Continues to Down Side

There was little change in the EUR’s movements against the US dollar, maintaining the negative activity close to the 1.1200 target. Technically, the price continuation and stability below the simple moving averages support the bearish curve in prices and gain solid bearish momentum in the short time frames. Therefore, we …

Read More »Market Drivers – European Session 23-11-2021

The White House announced during a press statement today, Tuesday, that the US President decided to release the strategic oil reserves of the United States of America, estimated at about 50 million barrels, within 3 months, to contribute to calming crude oil prices, especially since oil prices are high and …

Read More »Biden to Release Oil Reserves to Combat High Gas Prices

The White House announced during a press statement today, Tuesday, that the US President decided to release the strategic oil reserves of the United States of America, estimated at about 50 million barrels, within 3 months, to contribute to calming crude oil prices, especially since oil prices are high and …

Read More »The Dollar is at a 16-Month High, With a US Interest Rate Hike Expected in 2022

The dollar index rose to its highest level in 16 months and its strongest level in more than four years against the yen after the nomination of Federal Reserve Chairman Jerome Powell for a second term in office, which reinforced market expectations of higher US interest rates in 2022.The exchange …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations