U.S. President Donald Trump and Russian President Vladimir Putin are set to meet on Friday at a Cold War-era air base in Alaska, marking their first face-to-face encounter since Trump returned to the White House. The meeting is expected to center on efforts to reach a ceasefire in Ukraine, with …

Read More »European Stocks Near Five-Month High as Earnings Optimism Outweighs Inflation Concerns

European equities advanced on Friday, with the pan-European STOXX 600 climbing 0.2% by 07:17 GMT, buoyed by strength in miners and chemical stocks. The index is trading near its highest level in almost five months, supported by a largely upbeat corporate earnings season. Geopolitical Focus: U.S.-Russia TalksInvestors are also watching …

Read More »Gold Edges Up in Asia Despite Weekly Losses Amid Fed Rate Speculation

Gold prices in Asian trade on Friday inched higher, though they were set for a weekly decline, as investors weighed reduced expectations for a significant Federal Reserve rate cut against geopolitical developments, including U.S.-Russia talks scheduled later in the day. Spot gold rose 0.3% to $3,344.88 an ounce, while December …

Read More »Bitcoin Pulls Back from Record High as Hot U.S. PPI Data Tempers Fed Easing Bets

Bitcoin retreated on Friday, reversing from record highs above $124,000 as stronger-than-expected U.S. producer price data cooled expectations for aggressive Federal Reserve rate cuts next month. The world’s largest cryptocurrency fell 2.2% to $119,112.5 as of 02:04 ET (06:04 GMT), after touching an all-time high of $124,436.8 in the previous …

Read More »China’s July Economic Data Disappoints Amid Cooling Global Demand

China’s industrial production and retail sales for July fell short of market expectations, highlighting ongoing weaknesses in both domestic consumption and export demand, according to official data released Friday. Industrial Production SlowsIndustrial output grew 5.7% year-on-year in July, missing expectations of 6% and down from 6.8% in June. The slowdown …

Read More »Asian Markets Mixed as Japan GDP Surprises, Chinese Data Disappoints

Asian equity markets showed a mixed performance on Friday, with Japan’s stocks rallying on stronger-than-expected economic growth, while Hong Kong fell amid weak Chinese industrial and retail data. Trading volumes were thin in South Korea and India due to public holidays. Japan’s Economic Growth Supports NikkeiTokyo’s Nikkei 225 surged 1%, …

Read More »Dow Jones Shines as Bulls Take Control 15/8/2025

DowJones

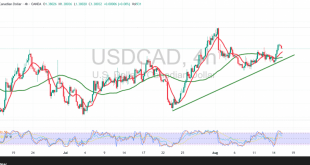

Read More »CAD Ends Rangebound phase, momentum rising 15/8/2025

An upward trend took hold of the USD/CAD pair after several sessions of sideways movement, with the pair reaching its highest level in the previous session at 1.3820. Technical Outlook – 4-hour timeframe: Following yesterday’s rise, intraday price action is showing a natural pullback, yet the pair remains firmly above …

Read More »Will the Pound Continue to Rise? 15/8/2025

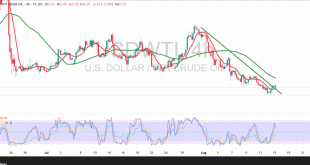

Oil, Crude, trading

Read More »Oil Eyes Key Level – Bulls VS Bears — Can They Hold On? 15/8/2025

An upward trend has dominated US crude oil futures, with prices attempting to recover losses from previous sessions. Technical Outlook – 4-hour timeframe: US crude has established solid support at $62.00, while the 50-period simple moving average continues to act as dynamic resistance from above. The Relative Strength Index (RSI) …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations