The seasonally adjusted IHS Markit/CIPS UK Services Purchasing Managers’ Index (PMI) was revised lower to 58.5 in November versus 58.6 expected and a 58.6 – last month’s flash reading. Gold futures rose 0.66% to $1,774.30 by 10:48 PM ET (3:48 AM GMT), after falling to their lowest level in nearly …

Read More »UK Final Services PMI Revised Down in November

The UK services sector activity expanded less than expected in November, the final report from IHS Markit confirmed this Friday. The seasonally adjusted IHS Markit/CIPS UK Services Purchasing Managers’ Index (PMI) was revised lower to 58.5 in November versus 58.6 expected and a 58.6 – last month’s flash reading.

Read More »Gold is Rising But Waiting For The Data

Gold rose on Friday morning in Asia. However, the yellow metal braced for its third consecutive weekly decline, weighed by signs that the US Federal Reserve will accelerate the pace of reduction in asset purchases and raise interest rates earlier than expected to curb inflationary pressures. Gold futures rose 0.66% …

Read More »Inflation in Turkey Jumps to a 3-Year High as The Lira Tumbles

Data on Friday showed that inflation in Turkey rose more than expected to 21.31% on an annual basis in November, its highest level in three years, exacerbating the decline in real yields after the unprecedented decline of the lira to its lowest levels ever. The Turkish Statistical Institute said consumer …

Read More »Japan’s Nikkei Reverses Its Trend And Closes Higher

Japan’s Nikkei index reversed course to close higher on Friday, led by travel and leisure stocks, as investors cashed in on battered stocks amid concerns about the impact of the mutated Omicron strain of the coronavirus. The Nikkei rose 1%, the largest percentage increase in three weeks, to close at …

Read More »GBP/JPY: Chances to Rise

Positive trades dominated the pound’s movements against the yen within a gradually ascending path to the upside, building on support level 149.90. On the technical side, we are inclined to the positivity, relying on stability above the mentioned support level and the clear positive crossover signs on the stochastic indicator. …

Read More »Canadian Continues to Advance

The technical outlook is unchanged, and the pair’s movements did not change significantly, maintaining the expected bullish path after building a good support floor around 1.2760 and, most importantly, 1.2730. Technically, the bullish trend is still valid, depending on the stability of daily trading above the strong support level at …

Read More »GBP is Facing Negative Pressure

Oil, Crude, trading

Read More »Oil Extends Losses Ahead of Data

Oil, Crude, trading

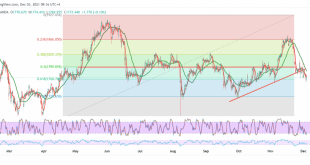

Read More »Gold Touches The Extended Bearish Target

Prices of the yellow metal declined significantly during the previous trading session, touching the second official target required to be achieved in the last technical report, at 1761, recording its lowest level at 1761.00. On the technical side today, and by looking at the 4-hour chart, we notice that gold …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations