From early 2025 to April 3, the U.S. stock market has navigated a turbulent phase marked by sharp volatility and liquidity declines, driven by factors like inflation, trade wars, and quantitative tightening, with examples like Gensol Engineering underscoring pressures on individual firms. For investors, this period demands flexible strategies to …

Read More »Sterling Soars as Trump Tariffs Trigger US Recession Fears, UK Spared the Worst

The Pound Sterling (GBP) surged to a near six-month high against the US Dollar (USD) on Thursday, breaching the 1.3200 mark, as President Donald Trump’s unexpectedly aggressive tariffs sent shockwaves through the global markets, igniting fears of a looming US recession. The dramatic rise in the GBP/USD pair was fueled …

Read More »Oil Prices Expected to Retreat Amid Output Hike

Oil prices dropped sharply on Thursday, extending steep declines as the OPEC+ alliance decided to accelerate the reversal of previous production cuts in May. This announcement amplified losses already triggered by sweeping new tariffs announced by U.S. President Donald Trump on Wednesday. By 1305 GMT, Brent crude futures had slumped …

Read More »Germany, France Urge Stronger EU Response to Trump’s Tariffs: Bloomberg

Germany and France are advocating for a robust European Union response following U.S. President Donald Trump’s latest tariff measures, pushing the bloc to adopt a more assertive stance in countering Washington’s escalating trade actions, according to a Bloomberg report published Thursday. A day after President Trump unveiled his controversial “Liberation …

Read More »Bitcoin Slides Amid Global Market Turmoil as New U.S. Tariffs Shake Investor Confidence

Bitcoin prices retreated on Thursday, as heightened global trade tensions stemming from newly announced U.S. tariffs dampened investor appetite for riskier assets, including cryptocurrencies. The leading cryptocurrency declined 0.8%, trading near $83,421.50 early Thursday, as markets digested the implications of significant tariff escalations initiated by the U.S. administration. The introduction …

Read More »European Markets Rattled as U.S. Tariff Announcement Sparks Global Economic Concerns

European equities tumbled sharply on Thursday, as investors grappled with mounting fears over escalating global trade tensions following new U.S. tariff measures on imports, deepening anxieties about worldwide economic stability. Early trading saw steep declines across Europe’s key indices: Germany’s leading index sank by 2.3%, France’s benchmark lost 2.2%, and …

Read More »Dow Jones is waiting for a wide price range 3/4/2025

Oil, Crude, trading

Read More »CAD threatens to break support 3/4/2025

The Canadian dollar has pulled back after a streak of gains, encountering strong resistance at 1.4360. This level prompted a reversal, with the pair declining to a session low near 1.4215. From a technical standpoint, the 4-hour chart highlights notable resistance just below the 50-period simple moving average, alongside clear …

Read More »GBP confirms the breakout 3/4/2025

Oil, Crude, trading

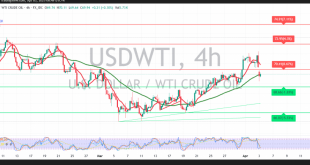

Read More »Oil below the moving average 3/4/2025

U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations