U.S. crude oil futures are experiencing volatility, reversing recent gains and opening the session with a bearish gap. At the time of writing, prices have dipped to a session low of $69.29 per barrel. From a technical perspective, the price has settled below the 50-day simple moving average at $70.90, …

Read More »Gold gets rid of oversold conditions 15/4/2025

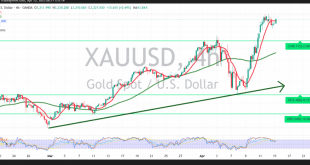

The key support level highlighted in the previous technical report at $3,190 successfully held, helping to maintain the broader upward trend. Following a rebound from this level, gold prices have resumed their climb, currently trading around $3,228 per ounce at the time of writing. On the 4-hour chart, price action …

Read More »The Euro benefits from momentum indicators 15/4/2025

The EUR/USD pair remains confined within a narrow sideways range, with a slight bearish bias, after touching a recent low of 1.1296 in the previous session. From a technical standpoint, the 4-hour chart shows the Relative Strength Index (RSI) beginning to ease out of oversold conditions, suggesting a potential shift …

Read More »Bouncing Back: Can Bitcoin Sustain the Recovery Amid Global Shifts?

The crypto market’s 2% dip to $2.8 trillion on Monday belies a broader story of resilience, with Bitcoin clawing its way above $85,100 after a 15% surge from last week’s $74,500 low. Solana and Ethereum are riding bullish waves, and U.S. spot Bitcoin ETF outflows are slowing, hinting at renewed …

Read More »Market Drivers – US Session: RBA Minutes and UK Jobs Data In Focus

The U.S. dollar’s slide into a fourth week of losses underscores a shifting global landscape, with investors buoyed by easing U.S.-China trade tensions and a brighter risk appetite. As attention turns to the Reserve Bank of Australia’s (RBA) latest meeting minutes and the UK’s labor market report, these releases promise …

Read More »Gold Declines as Investor Focus Shifts Back to US Treasury Bonds

Gold prices slipped at the start of Monday’s trading session, driven by renewed investor interest in US Treasury bonds, which saw increased demand at the beginning of the new week. This resurgence follows a period of waning confidence in bonds as one of the safest assets in global financial markets.Futures …

Read More »US Dollar Stages Modest Recovery Amid Lingering Stagflation Fears

The US Dollar Index (DXY) saw turbulent trading near the 99 level during Monday’s session, rebounding slightly after touching a three-year low. Despite ongoing concerns over tariff uncertainties, declining consumer confidence, and heightened inflation expectations, the index stabilized around 99.60. These issues continue to weigh heavily on market sentiment. Technically, …

Read More »US and Japan Gear Up for High-Stakes Trade Talks, with Implications for USD/JPY

As Japan and the United States gear up for crucial trade negotiations set to begin in Washington on Thursday, global markets are closely observing the proceedings. These discussions position Japan as the first major economy to engage with the current US administration following a significant tariff announcement earlier this month. …

Read More »Tariffs Present a Major Economic Challenge, Says Fed’s Waller

Federal Reserve Governor Christopher Waller has described the current administration’s tariff policies as one of the most substantial shocks to the US economy in recent decades. These measures could prompt the central bank to reduce interest rates to stave off a recession, though they might also be a strategic negotiating …

Read More »GBP/USD Eyes 1.3200 and Beyond Amid Dollar Weakness and Tariff Optimism

The GBP/USD pair has kicked off the trading week on a strong note, revisiting the 1.3200 level as the British pound extends its bullish run. Fueled by persistent weakness in the US dollar, the so-called “Cable” has notched its fifth consecutive daily advance, reaching multi-day highs near the 1.3200 mark. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations