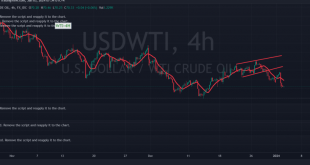

Oil, Crude, trading

Read More »Oil suffers huge losses 3/1/2024

Oil prices did not align with the positive outlook as anticipated, which was based on the assumption of trading stability above the psychological barrier support level of 71.00 at the time of the report’s issuance. The report highlighted that a return to trading stability below 71.00 would cease attempts to …

Read More »Gold gets a negative signal 3/1/2024

Gold prices exhibited diverse movements, initially achieving the first upward target as indicated in the previous report, reaching the price of 2076 and marking a peak at 2078. However, subsequent negative pressure led to a decline, and the price recorded $2055 per ounce. From a technical analysis perspective today, a …

Read More »EUR touches the downside target 3/1/2024

The EUR/USD pair experienced a significant decline in the previous trading session, aligning with the bearish expectations outlined in the earlier technical report. It touched the second target at 1.0960, marking a low of 1.0938. From a technical standpoint today, a closer examination of the 240-minute time frame chart reveals …

Read More »Market Drivers – US Session, January 3, 2024

On Tuesday, the US dollar emerged victorious overall, with a strong appreciation vs all of its main competitors. By the end of 2024, investors were back in the USD due to signals of slowing global growth. S&P Global published the Manufacturing PMIs for December for a number of significant economies, …

Read More »WTI falls by 1% after briefly surging

Earlier on the trading day, oil rose on the back of news reports about ship attacks near Yemen. However, economic data continues to soften. OPEC production unexpectedly increased, further pressuring WTI bids. News reports of ongoing attacks on cargo ships off the coast of Yemen sparked a brief rally in …

Read More »GBP/USD sees retreats on stronger dollar ahead of jobs data

The GBP/USD pair fell below the 20-day SMA, reaching 1.2320. The US dollar’s recovery was fueled by rising yield rates and a risk-off market mood. December’s labour market figures are expected to influence Fed’s next monetary policy decisions. If the US economy continues to show resilience, the pair is likely …

Read More »Traders’ Attention Shifts To FOMC Minutes, JOLTS Report

On Wednesday, traders’ attention will be centered on US economic data, with bets on the direction of interest rates continuing, as earnings and updates are once again scarce.Fed is determined to monitor emerging economic data before indicating any changes to future monetary policy, so the Job Openings and Labour Turnover …

Read More »Canada’s dollar slides against US counterpart on PMI data

The Canadian Dollar is easing back against the US Dollar as the 2024 trading year begins, with the Canadian S&P Global Manufacturing Purchasing Managers’ Index (PMI) falling to a 43-month low. The US Manufacturing PMI component also fell below expectations, keeping market risk appetite low and propping up the US …

Read More »Wall Street begins 2024 down on surging yields rise

The first trading session of 2024 saw a decline in the US stock market as investors lowered their expectations for interest rate cut this year. Tuesday’s drop in Apple shares is due to a downgrade by Barclays. Tesla continues to deliver record numbers in Q4. The drab beginning comes after …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations