Oil, Crude, trading

Read More »Oil Show Mixed Trading, Eyes on Key Technical Levels 12/1/2024

US crude oil futures exhibited mixed trading in the previous session, eventually returning to an upward trend after finding support around the pivotal level of 71.20. From a technical standpoint, there is a cautious positive outlook. The price is receiving positive signals from the simple moving averages, which have provided …

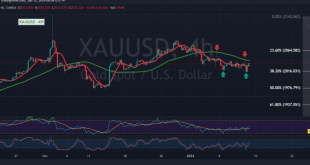

Read More »Gold: Technical Signals Indicate Conflicting Trends, Await Key Breakouts 12/1/2024

Gold experienced a downward trend in the previous trading session, testing the main support around 2016, before concluding the day’s trading above this support and embarking on an upward rebound, targeting a retest of 2035. Analyzing the 240-minute chart, conflicting technical signals emerge. The 50-day simple moving average poses a …

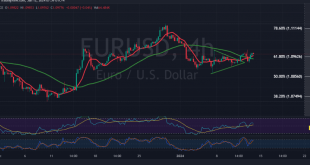

Read More »EUR/USD Pair Approaches Key Resistance 12/1/2024

The EUR/USD pair has initiated an assault on the primary resistance level at current trading levels around 1.0960, reaching its highest point close to the psychological barrier of 1.1000. Upon examining the 4-hour time frame chart from a technical analysis perspective, the simple moving averages provide a positive indication, supporting …

Read More »Market Drivers – US Session, Jan 11

Following Iran’s announcement early on Thursday that a civilian oil tanker had been captured in the Gulf of Oman, WTI crude oil saw a spike in price. The seizure, according to official Iranian state media, was a reprisal for the US seizing the identical ship, which was headed towards Iran, …

Read More »Gold price recovers ahead of China’s CPI

In the early Asian session on Friday, the price of gold rises from the weekly low of $2,013 to $2,030. The chance that the Fed would not start lowering interest rates as soon as anticipated, however, might restrict the upside of the yellow metal and put some selling pressure on …

Read More »GBP/USD edges higher ahead of key UK GDP, US PPI data

The Bank of England may be facing a deadline for its first rate decrease because of a possible faster pace of decline in inflation, which is why the GBP/USD pair is trading strongly for the third day in a row. The US CPI inflation data could put the Federal Reserve’s …

Read More »Fresh US – Chinese row on chipmaking

Wang Wentao, China’s commerce minister, has voiced worries about US export restrictions that bar foreign nations from sending lithography machines to China. With these restrictions, the US has prevented China from obtaining cutting-edge chips and the equipment needed to produce them, which may support AI and highly developed computers for …

Read More »Fed’s Mester: March probably too early for rate cut

The rocky path of getting inflation back to the US Federal Reserve’s 2% target rate reflected in the latest Consumer Price Index (CPI) figures means that it would likely be too soon for the central bank to cut its policy rate in March, Cleveland Fed President Loretta Mester said on …

Read More »Gold deteriorates below 2015 after US CPI data

Gold prices have been volatile due to high price pressures in the United States in December, and investors seem confident about the Federal Reserve reducing interest rates in March. The precious metal is trading at $2014.69 at the time of writing.The United States Bureau of Labour Statistics reported hotter-than-projected Consumer …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations