Analysis of Gold’s Performance Amid Dollar Decline and US Economic Data As the week unfolds, gold prices are on track to secure their most substantial weekly gains in nine weeks, buoyed by a combination of factors ranging from a weakening dollar to declining US Treasury bond yields. Investors, closely watching …

Read More »CAD: negative pressure exists 2/2/2024

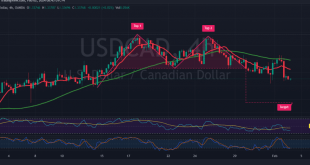

The Canadian dollar pair encountered a robust resistance at 1.3465, prompting the completion of the anticipated downward trajectory mentioned in the previous report. The pair reached the first target at 1.3380, touching its lowest point at 1.3367. In today’s technical analysis, a negative bias is observed in trading, hinging on …

Read More »USD/JPY continue to decline 2/2/2024

japanese-yen

Read More »GBP attacks the resistance 2/2/2024

Oil, Crude, trading

Read More »Oil breaks support and negativity remains 2/2/2024

US crude oil futures witnessed mixed trading during the previous session, experiencing fluctuations between upward and downward movements. The price ranged from its lowest point at $73.74 to the highest near $79.00 per barrel. A detailed analysis of the 4-hour chart reveals the simple moving averages exerting downward pressure on …

Read More »Gold continues to rise 2/2/2024

Gold prices successfully reached the initial target mentioned in the previous technical report, hitting $2065 per ounce, marking the highest level in the current upward wave. The current technical analysis suggests a potential continuation of the upward trend, supported by positive signals from the simple moving averages. Intraday trading stability …

Read More »Euro is trying to recover 2/2/2024

The euro exhibited positive momentum against the US dollar, driven by the proximity to a robust support level at 1.0770, marked by the 38.20% Fibonacci retracement. Examining the 4-hour time frame chart from a technical standpoint, the mentioned support level prompted a retest of the formidable resistance at 1.0875, coinciding …

Read More »Market Drivers – US Session, February 1

The US Dollar Index retreated, putting the 103.00 support to the test, dropping back below the important 200-day SMA. On Friday, all eyes will be on January’s nonfarm payrolls, the unemployment rate, factory orders, and the final print of Michigan Consumer Sentiment.Renewed selling pressure in the dollar, combined with more …

Read More »What could January’s NFP Data bring about in financial markets?

The US Bureau of Labour Statistics will release its jobs report for January on Friday, February 2, and economists and researchers predict a 180,000 rise in Nonfarm Payrolls following the stronger-than-expected 216,000 recorded in December. Investors’ focus now shifts to Friday’s nonfarm payrolls for further clarity on the future of …

Read More »Middle East talks drag WTI lower after early surge on supply concerns

Crude oil prices were volatile on Thursday due to geopolitical concerns in the one direction towards calmer Middle East, and supply concerns in the other direction; triggering an earlier rally on the day. The likelihood of a negotiated ceasefire in Gaza is growing. The crude oil barrel counts from the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations