The USD/JPY pair is climbing over 0.90% to 148.05 after a strong US jobs report and higher Treasury yields. January’s 353K job additions lessen Fed rate cut forecasts, indicating a tighter labour market.The US 10-year Treasury yield and Dollar Index signal robust confidence in the US economy. The pair is …

Read More »S&P 500, Nasdaq leap on soaring tech earnings including Meta

The S&P 500 and Nasdaq rose on Friday due to strong tech earnings and a stronger-than-expected jobs report. The broad market index added 1.3%, while the Nasdaq Composite climbed 1.9%. Meta shares soared over 22% after defying analysts’ expectations. The company announced it will pay a quarterly dividend for the …

Read More »Consumer sentiment at highest level since July 2021

Consumer sentiment in the United States has hit its highest point since July 2021, with consumers anticipating increases in both inflation and personal income.According to the University of Michigan’s Surveys on Consumers, the index reached this level after a 13% month-over-month improvement in January, which was preceded by a 14% …

Read More »US dollar gets prepared for winning week post surprise NFP data

The US dollar has rallied and was able to hold on to gains after the January Jobs Report, with the US Dollar Index popping over 103 and on track to break 104 soon. At the time of writing the Dollar Index is at the 103.883 mark.The NFP report showed a …

Read More »Turkey Reports Significant Reduction in Trade Deficit in January

Analysis of Trade Minister’s Announcement on Economic Indicators Turkey’s Trade Minister, Omer Polat, announced on Friday that the country witnessed a substantial reduction in its trade deficit, marking a positive development for the nation’s economic indicators. According to Polat, the trade deficit shrank by 56.8 percent year-on-year, amounting to $6.17 …

Read More »European Stocks Gain Ground on Positive Corporate Reports and Wall Street Momentum

Analysis of Market Movement and Notable Performers As the trading day commenced in Europe, stocks experienced an upward trajectory on Friday, driven by a slew of positive reports from regional companies. The European STOXX 600 index, a broad gauge of European equities, rose by 0.4 percent by 0830 GMT, signaling …

Read More »Dollar Retreats on Positive Tech Earnings and Market Optimism

Analysis of Dollar Movement Amidst Positive Market Sentiment On Friday, the US dollar experienced a decline as risk appetite surged, propelled by positive business results from major technology companies on Wall Street. Investors eagerly awaited the release of the closely watched non-farm payrolls report later in the day, seeking insights …

Read More »Gold Poised for Best Weekly Gains in Nine Weeks as Economic Indicators Drive Market Sentiment

Analysis of Gold’s Performance Amid Dollar Decline and US Economic Data As the week unfolds, gold prices are on track to secure their most substantial weekly gains in nine weeks, buoyed by a combination of factors ranging from a weakening dollar to declining US Treasury bond yields. Investors, closely watching …

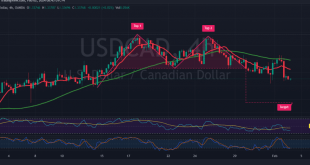

Read More »CAD: negative pressure exists 2/2/2024

The Canadian dollar pair encountered a robust resistance at 1.3465, prompting the completion of the anticipated downward trajectory mentioned in the previous report. The pair reached the first target at 1.3380, touching its lowest point at 1.3367. In today’s technical analysis, a negative bias is observed in trading, hinging on …

Read More »USD/JPY continue to decline 2/2/2024

japanese-yen

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations