The Canadian dollar came under renewed pressure in recent intraday trading after encountering strong psychological resistance at 1.3900, which triggered a downside reaction and negative momentum. On the 4-hour chart, the rejection from 1.3900 has been reinforced by the simple moving averages, which continue to act as dynamic resistance levels. …

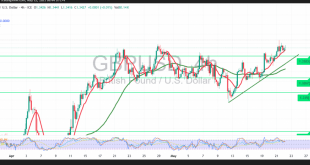

Read More »GBP Attempts to Gain Ground Against the Dollar 22/5/2025

Oil, Crude, trading

Read More »Crude Oil Breaches Support Line 22/5/2025

U.S. crude oil futures experienced mixed trading in the previous session after testing the psychological resistance level at $64.00, which effectively halted the upward momentum and capped further gains. Technically, oil is now stabilizing around $61.60. A closer look at the 4-hour chart reveals that the price has broken below …

Read More »Gold Holds Firm to Its Uptrend 22/5/2025

Gold prices have surged in recent intraday trading, breaking decisively above the key $3,270 resistance level and reaching a new high of $3,345. From a technical analysis perspective, the bullish trend remains firmly in place. The Relative Strength Index (RSI) continues to gain upward momentum, holding above the 50 midline, …

Read More »Euro Eyes a Potential Break Above Resistance 22/5/2025

The euro advanced against the U.S. dollar in the previous trading session, reaching a session high of 1.1362. From a technical analysis perspective, the 4-hour (240-minute) chart shows that the EUR/USD pair has successfully consolidated above the previously breached resistance at 1.1255, now acting as support in accordance with the …

Read More »Market Drivers – US Session: Dollar Sinks to Two-Week Lows as Debt Fears and Weak Data Rattle Markets

The US dollar plummeted to two-week lows on May 22, 2025, with the US Dollar Index (DXY) breaching the 100.00 mark, driven by fears over President Donald Trump’s deficit-bloating tax bill and a faltering US economy. As GBP/USD hit 1.3470 and gold topped $3,300, global markets braced for volatility. Experts …

Read More »Trump’s Massive Budget Bill Nears Vote, Risks Ballooning US Debt

The US House prepares to vote on President Donald Trump’s “One Big Beautiful Bill Act,” a sprawling tax and budget package set to add $3 trillion to $4 trillion to the $36 trillion US deficit over a decade. Despite internal Republican dissent, the bill’s hefty tax breaks and spending hikes …

Read More »Pound Rises Against Dollar as UK Inflation Spikes and US Debt Woes Deepen

The British pound climbed against the US dollar during the US session on May 22, 2025, with GBP/USD reaching 1.3419, up from 1.3392, driven by surging UK inflation and mounting concerns over America’s $36 trillion debt burden. UK consumer prices jumped to 3.5% in April, exceeding forecasts, while the US …

Read More »Yen Surges as US Debt Fears and Safe-Haven Demand Drive Dollar Down

The Japanese yen rallied against the US dollar on May 21, 2025, with USD/JPY dropping to 143.61 from 144.50, defying the usual link between rising US Treasury yields and dollar strength. Fueled by Japan’s climbing bond yields and safe-haven flows amid Middle East tensions, the yen’s ascent reflects growing US …

Read More »US Tax Retaliation Sparks Global Trade Fears, Threatens Investment

The US House’s reconciliation bill, unveiled on May 12, 2025, targets foreign tax policies like the global minimum tax’s undertaxed profits rule (UTPR), digital services taxes (DSTs), and diverted profits taxes (DPTs) with punitive measures, risking over 80% of US foreign direct investment (FDI). As President Donald Trump’s administration pushes …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations