Bitcoin’s price took a nosedive on Friday, sinking to a four-month low as concerns over the impending distribution of stolen Bitcoin by the defunct crypto exchange Mt Gox intensified. The situation was further compounded by reports of German police moving $75 million of confiscated crypto onto exchanges, sparking fears of …

Read More »Bitcoin Plummets to 4-Month Low Amid Mt Gox, Political Turmoil

Bitcoin’s price took a nosedive on Friday, sinking to a four-month low as concerns over the impending distribution of stolen Bitcoin by the defunct crypto exchange Mt Gox intensified. The situation was further compounded by reports of German police moving $75 million of confiscated crypto onto exchanges, sparking fears of …

Read More »Gold Prices Continue Climb on Rate Cut Expectations, Awaiting Payrolls Data

Gold prices continued their upward trajectory in Asian trading on Friday, building on recent gains as the dollar weakened ahead of crucial nonfarm payrolls data, which is expected to offer further insights into the future of interest rates. Key Points: Gold Gains Momentum: Spot gold rose 0.3% to $2,363.61 an …

Read More »Asian Stocks Mixed Amid EU-China Trade Tensions, Samsung Boosts South Korea

Asian stock markets presented a mixed picture on Friday. Chinese stocks declined due to new European Union tariffs on electric vehicle imports, escalating trade war concerns. Conversely, South Korean markets outperformed, driven by gains in Samsung Electronics, which reported a significant surge in Q2 profits, primarily attributed to increased demand …

Read More »Dow Jones: Bullish Momentum Continues, Upside Breakout Eyed 5/7/2024

Oil, Crude, trading

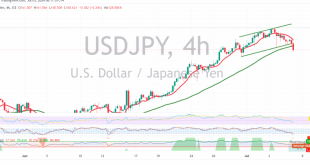

Read More »USD/JPY: Correction Potential Amidst Resistance and Negative Signals 5/7/2024

japanese-yen

Read More »GBP/USD: Bullish Momentum Strengthens, Upside Potential Ahead 5/7/2024

Oil, Crude, trading

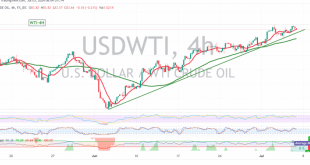

Read More »WTI: Mixed Trading Amidst Bullish Outlook 5/7/2024

US crude oil futures prices experienced mixed trading in the previous session, encountering resistance at the 83.90 level and failing to break through. However, the price remains within the bullish context and is supported by the 50-day simple moving average around 82.50. Technical Outlook: On the 4-hour chart, the price …

Read More »Gold: Bullish Breakout, Upside Potential Ahead 5/7/2024

Gold prices have broken out of the previous sideways range, consolidating above the 2340 resistance level (23.60% Fibonacci retracement) as anticipated in our previous analysis. This breakout signals a potential shift in momentum towards a bullish trend. Technical Outlook: On the 4-hour chart, the price is now trading above the …

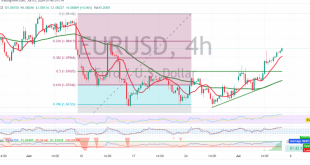

Read More »EUR/USD: Bullish Breakout, Upside Potential Ahead 5/7/2024

After four sessions of consolidation due to conflicting signals, the EUR/USD pair has decisively broken above the key 1.0760 resistance level (50.0% Fibonacci retracement), reaching a high of 1.0824 in early trading today. Technical Outlook: On the 4-hour chart, the pair is now holding above the psychological resistance of 1.0800, …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations