European stocks opened flat on Tuesday, with gains in the technology sector balancing out losses in metal miners. This balanced start follows the market’s best performance in over a month on Monday. Driving the technology sector’s upward momentum were strong earnings reports from software giant SAP and computer peripherals manufacturer …

Read More »Dow Jones: Bearish Momentum Builds 23/7/2024

Oil, Crude, trading

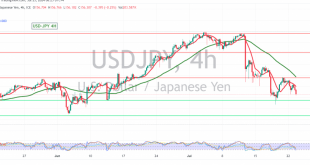

Read More »USD/JPY: Bearish Momentum Builds 23/7/2024

japanese-yen

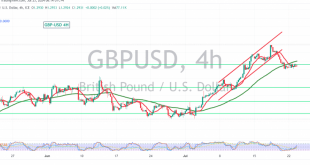

Read More »GBP/USD: Narrow Range Trading with Bearish Bias 23/7/2024

Oil, Crude, trading

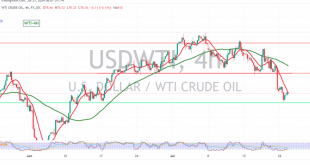

Read More »WTI: Bearish Momentum Builds, Further Downside Anticipated 23/7/2024

US crude oil futures prices experienced a significant decline in the previous trading session, reaching a low of $77.60 per barrel. Technical Outlook: The technical outlook has shifted to a bearish bias. The simple moving averages (SMAs) are now supporting the current downward wave, and the Relative Strength Index (RSI) …

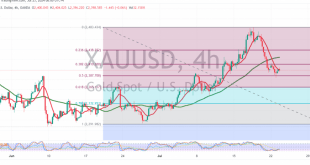

Read More »Gold: Bearish Momentum Builds, Further Downside Anticipated 23/7/2024

Gold prices have experienced a downward trend, retreating from the recent historical peak of $2483. The technical outlook suggests a continuation of this corrective movement. Technical Outlook: On the 4-hour chart, the simple moving averages (SMAs) have formed a negative crossover, indicating increased selling pressure. Moreover, the price remains below …

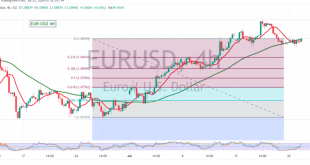

Read More »EUR/USD: Range-Bound with Potential for Bearish Correction 23/7/2024

The EUR/USD pair is experiencing subdued trading at the start of this week, remaining below the key psychological resistance level of 1.0900. Technical Outlook: On the 240-minute chart, the Stochastic oscillator is gradually losing upward momentum, indicating a potential shift in sentiment. Additionally, the price is consolidating below the pivotal …

Read More »Asian Stocks Mostly Rise on Tech Rebound, China Lags Despite Rate Cut

Asian stock markets saw a mixed performance on Tuesday, with most indices rising as technology stocks rebounded from recent losses. However, Chinese markets remained under pressure due to ongoing concerns about the country’s economic outlook and the potential for renewed trade tensions with the U.S. under a possible Donald Trump …

Read More »Gold Prices Stabilize After Recent Decline, Focus Turns to Fed Meeting and U.S. Politics

Gold prices saw little movement in Asian trade on Tuesday, hovering near 11-day lows as traders sought further clarity on U.S. political developments and monetary policy ahead of the Federal Reserve meeting next week. Despite a significant drop from record highs reached earlier this month, gold remained relatively stable due …

Read More »How could markets react to Trump’s potential victory in US elections?

Donald Trump, the Republican presidential contender and former US president, has emerged as a new influential force in the financial markets in the recent past, and his chances of winning the US presidential election in 2024 are being closely watched. These prospects have grown recently due to certain developments that …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations