Oil, Crude, trading

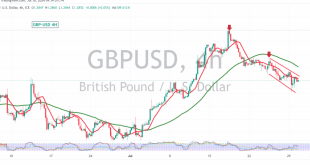

Read More »GBP needs a negative stimulus 30/7/2024

Oil, Crude, trading

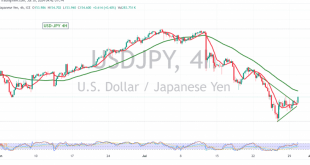

Read More »USD/JPY Trying to Recover 30/7/2024

japanese-yen

Read More »Oil breaks support 30/7/2024

US crude oil futures experienced significant losses in the early trading sessions of this week, reaching the projected targets from the previous report at 76.40 and 75.95, and coming close to the next target of 75.10, with a low of $75.39 per barrel during this morning’s trading. Technically, the 4-hour …

Read More »Gold needs to monitor price action 30/7/2024

Gold prices continue to fluctuate within a narrow range, bounded by the support level at 2366 and the resistance level at 2394. From a technical analysis standpoint, the simple moving averages are acting as resistance, while trading remains below the key resistance level of 2394. This bearish sentiment is further …

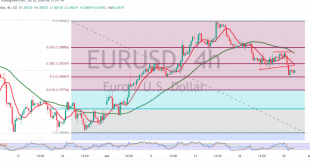

Read More »Euro continues gradual decline 30/7/2024

The Euro continued its decline against the US Dollar, following the anticipated downward trajectory outlined in the previous technical report. The pair reached the first official target at 1.0810, hitting a low of 1.0802. On the technical front today, a closer examination of the 240-minute chart reveals that the simple …

Read More »Noor Capital | Mohammed Hashad’s Interview on Dubai TV, July 29

Dubai TV hosted Mohammed Hashad, Head of Research and Development at Noor Capital, and a member of the US Association of Technical Analysts, to comment on and shed light on market movements. United StatesThe Dow Jones saw a boost following Microsoft’s recent announcement of a new update to the Bing …

Read More »Market Drivers; US Session, July 29

The US dollar strengthened significantly on Monday, reaching its highest level in several days as investors adopted a cautious stance. Anticipation for upcoming central bank decisions and key economic data is driving market sentiment.Key Economic Indicators Today’s focus is on consumer confidence, alongside job openings data, house price index, and …

Read More »Markets Struggle Amid Geopolitical Risks, FOMC Decision Outlook

Global financial markets concluded the first trading day of the new week under the sway of mounting geopolitical tensions in the Middle East, which dampened risk appetite. This led to a decline in several risky assets by the end of Monday’s trading session. However, another factor intervened to balance investor …

Read More »Gold Retreats From Recent Highs On Stronger US Dollar

Following mixed economic data and the stronger US dollar which is in the green territory, up 0.23% and trades in the 104.569 neighborhood, the price of gold is finding it difficult to gain momentum. The dollar increased 0.2% ahead of this week’s pivotal Federal Open Market Committee’s meeting, and on …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations