The U.S. dollar rebounded on Thursday following a decline the previous day, as central bank decisions continued to impact currency markets. The dollar index, which measures the dollar against six major peers, rose by 0.29% to 104.35. This recovery came after a 0.4% drop the day before, when the Federal …

Read More »European shares lower on earnings

Major European equity markets experienced declines on Thursday, impacted by corporate earnings reports from both the U.S. and Europe. Meanwhile, expectations of forthcoming policy easing in the United States supported global bond markets. The Federal Reserve maintained interest rates on Wednesday but hinted at a potential cut in September. Traders …

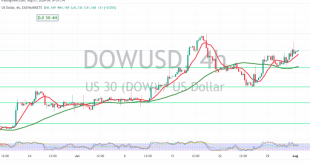

Read More »Dow Jones starts positively 1/8/2024

Oil, Crude, trading

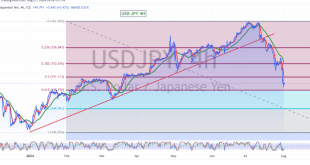

Read More »USD/JPY suffers heavy losses 1/8/2024

japanese-yen

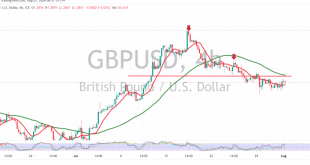

Read More »GBP needs a negative stimulus 1/8/2024

Oil, Crude, trading

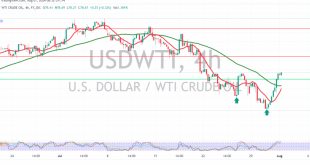

Read More »Oil makes notable gains 1/8/2024

US crude oil futures surged yesterday, reaching a high of $78.70 per barrel. Technically, the 4-hour chart indicates that oil has moved above the 50-day simple moving average, supporting a positive outlook. Additionally, the price is holding above the 78.00 support level. Given this stability, the upward trend appears likely …

Read More »Gold extends gains 1/8/2024

Gold prices saw notable gains in the previous trading session. Previously, we maintained a neutral stance due to conflicting technical signals, noting that a break above 2394 could trigger an upward trend towards targets of 2410 and 2420, with potential further gains extending to 2437. The price has now reached …

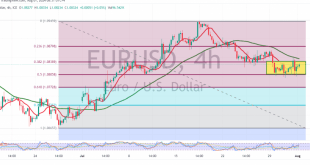

Read More »Euro awaits new move signal 1/8/2024

The EUR/USD pair experienced narrow sideways trading, confined between the support level at 1.0800 and the resistance level at 1.0850. Technically, the 240-minute chart shows continued negative pressure from the simple moving averages, alongside the stability of daily trading below the pivotal resistance level of 1.0880. Given these conditions, there …

Read More »Jerome Powell Takes Center Stage After Fed’s Interest Rate Decision

The Federal Reserve, under the leadership of Chairman Jerome Powell, has demonstrated unwavering commitment to aligning and determination to adjust its actions with market expectations. Their recent decision to maintain interest rates without deviation from prevailing trends reflects this resolve. By doing so, Powell aims to instill confidence in investors …

Read More »Which scenario will BoE meeting follow?

The Bank of England faces a critical decision on interest rates as policymakers weigh whether to reduce borrowing costs for the first time since the onset of the Covid-19 pandemic. Following a significant decline in inflation this year, Threadneedle Street is poised for its first rate cut since raising interest …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations