Gold experienced a downward trend during yesterday’s session, moving within a weak and somewhat indecisive pattern that deviated from the anticipated bullish outlook. Despite this, the price remained above the key support level of $3,390, recording a session low at $3,373 per ounce. From a technical standpoint, today’s outlook remains …

Read More »Euro Seeks to Relieve Overbought Pressure 17/6/2025

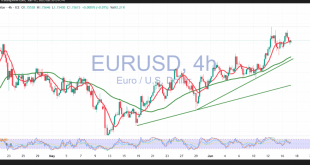

The EUR/USD pair is currently undergoing a bearish correction following several sessions of sustained gains, with the euro unable to maintain a foothold above the key psychological resistance level of 1.1600. As of the latest data, the pair is trading near 1.1555. From a technical perspective, the 4-hour chart indicates …

Read More »Gold Holds Firm, But Below $3,400 as Middle East Tensions Ease and Fed Looms

Gold Retreats Amid De-escalation SignalsGold prices slide below $3,400 on Monday, with XAU/USD at $3,383, down 1.45% earlier during the North American trading session from an eight-week high of $3,452. Yet, the yellow metal has later managed to edge up +0.33% and is trading at $3,396.77 at the time of …

Read More »Market Drivers – US Session: BoJ Meeting and Key Data in Focus

US Dollar Faces Continued PressureThe US Dollar Index (DXY) slipped below the 98.00 support level, reflecting persistent downward momentum. Despite rising US yields, the dollar struggles against its rivals, driven by market caution surrounding the Middle East conflict and anticipation of central bank decisions. On June 17, key US data …

Read More »Airlines Crash Amid Geopolitical Storm Hitting Stocks and Revenues

The Israel-Iran conflict, ignited by strikes on June 13, 2025, has sent airlines spiraling into financial chaos. Airspace closures, surging fuel costs, and crashing stocks have gutted revenues, while energy and defense sectors ride the wave. This crisis exposes a brutal truth: geopolitical shocks can paralyze global travel overnight. Here’s …

Read More »EUR/USD Rises Amid Middle East Tensions and Fed Policy Watch

Euro Gains as Risk Appetite ReboundsThe EUR/USD pair climbs to 1.1572 on June 16, 2025, up 0.17% from a daily low of 1.1523, recovering from a 0.25% loss last Friday when Israel-Iran hostilities escalated. Despite Iran’s fresh missile attacks on Tel Aviv and Haifa, markets perceive a reduced risk of …

Read More »Dow Jones Rises on Hopes Geopolitical De-escalation, G-7 Diplomacy

The Dow Jones surged 350 points on June 16, 2025, reclaiming 42,500, driven by optimism for a potential resolution to the Israel-Iran conflict and President Donald Trump’s diplomatic engagements at the G-7 summit in Canada. Despite trade uncertainties and ongoing Middle East tensions, markets leaned into a risk-on mood, though …

Read More »USD/JPY Steady as Bank of Japan’s Policy Decision Looms

The USD/JPY pair lingers near 144.20, with markets on high alert for the Bank of Japan’s (BoJ) monetary policy decision on June 16–17. This pivotal moment could shift the Japanese Yen’s trajectory against the US Dollar, influenced by Japan’s policy moves and global economic currents. The stark monetary policy divide …

Read More »Trump Pushes Iran Talks, Proposes G-7 Expansion Amid Global Strains

President Donald Trump’s attendance at the Group of Seven (G-7) summit in Canada on June 16, 2025, unfolds against a volatile global landscape marked by U.S. tariffs, the Israel-Iran conflict, and domestic political unrest. His calls for Iran to negotiate a nuclear deal, alongside provocative suggestions to reshape the G-7 …

Read More »U.S. Stock Index Futures Edge Higher Ahead of Fed Meeting and G7 Summit

U.S. stock index futures edged higher on Monday, attempting to recover some of last week’s sharp losses, while investors awaited the Federal Reserve’s interest rate decision later in the week. As of 05:25 ET (09:25 GMT), Dow Jones Futures rose by 145 points, or 0.4%, S&P 500 Futures gained 27 …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations