European stock markets declined on Thursday as ongoing tensions in the Middle East dampened investor sentiment. Traders are also awaiting the release of key regional economic activity data, particularly services PMI reports, which could influence monetary policy expectations. By 07:05 GMT, Germany’s DAX index fell 0.4%, while France’s CAC 40 …

Read More »Oil Prices Climb Amid Middle East Conflict Despite Rising U.S. Crude Inventories

Oil prices surged on Thursday as escalating tensions in the Middle East raised concerns about potential disruptions to crude flows from the key exporting region. Despite a rise in U.S. crude inventories, the threat of a widening conflict overshadowed the stronger global supply outlook. By 06:15 GMT, Brent crude futures …

Read More »Dow Jones: Negativity persists 3/10/2024

Oil, Crude, trading

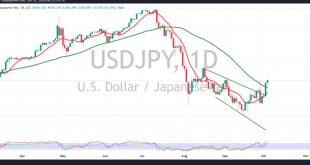

Read More »USD/JPY Extends Gains 3/10/2024

japanese-yen

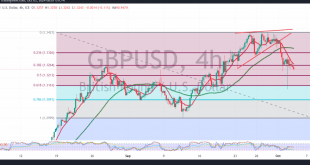

Read More »GBP retests support 3/10/2024

Oil, Crude, trading

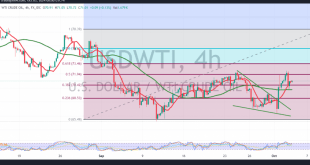

Read More »Oil tries to renew chances of rising 3/10/2024

Crude oil prices experienced mixed trading with a positive tendency, reaching a peak at $72.45 per barrel amidst ongoing geopolitical tensions. Technically, the outlook remains cautiously optimistic, with oil prices continuing to receive positive momentum from the 50-day simple moving average. This is supported by stable intraday trading above the …

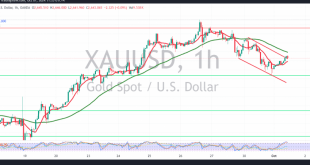

Read More »Gold under negative pressure 3/10/2024

Gold prices have been trading in a narrow sideways range, with support holding above the 2645 DGM level and resistance below 2665. The technical outlook for today suggests the possibility of continuing the corrective decline, especially after gold failed to break through the 2665 resistance. A closer look at the …

Read More »Euro presses support 3/10/2024

The EUR/USD pair experienced negative trading in the previous session, diverging from the expected upward trend outlined in the last technical report, where we relied on the pair maintaining stability above the psychological support level of 1.1100. As previously indicated, breaking through 1.1100, and more importantly 1.1095, would halt the …

Read More »Market Drivers; US Session, Oct. 2

The US dollar continued to rise and hit new three-week highs, supported by growing US rates and an ongoing risk-on attitude in reaction to escalating Middle East tensions. The US Dollar Index (DXY) surged to all-time highs of over 101.70 as a result of the ongoing risk aversion and growing …

Read More »Middle East conflict boosts oil prices despite large US crude buildup

Oil prices increased due to concerns about potential disruptions in Middle East oil supplies. A large increase in U.S. crude oil inventories limited the rise in prices. Iran launched a significant missile attack on Israel. Israel and the United States vowed to retaliate for the attack. Israel may target Iranian …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations