The confluence of geopolitical, economic, and supply-demand factors has driven WTI prices to a two-week low. While the immediate catalyst was Israel’s pledge to avoid targeting Iran’s oil facilities, the broader context reveals a complex interplay of forces shaping the global crude oil market.Geopolitical TensionsIran’s Nuclear Program: The ongoing tensions …

Read More »The ECB’s Rate Cut and Global Economic Outlook

The European Central Bank (ECB) is poised to deliver its third interest rate cut of the year at its meeting this Thursday, as policymakers signal that inflation risks are easing more rapidly than anticipated. Markets have already factored in a 25 basis point reduction and are even speculating about a …

Read More »Yen Weakens Following Bank of Japan Comments

The Japanese yen continued its downward trend from the start of trading on Wednesday, influenced by statements from the Bank of Japan suggesting a tendency among Japanese monetary authorities to delay raising interest rates, which could add upward momentum to the Japanese currency.The dollar/yen pair rose to 149.67 compared to …

Read More »Oil Prices Steady Amid OPEC+ Cuts and Middle East Uncertainty

Oil prices stabilized on Wednesday as OPEC+ production cuts and ongoing uncertainty in the Middle East balanced out a weakening demand outlook and expectations of ample supply in 2024. Brent crude oil futures inched up by 16 cents (0.2%) to $74.41 a barrel, while U.S. West Texas Intermediate (WTI) crude …

Read More »European Tech and Luxury Stocks Slump Amid Disappointing Earnings and ECB Caution

European tech and luxury stocks took a hit on Wednesday following weak earnings reports from key players like ASML and LVMH, adding to market jitters ahead of the European Central Bank’s (ECB) upcoming policy decision. The STOXX 600 index fell by 0.3%, pulling back further from a recent two-week high. …

Read More »U.S. Dollar Strengthens on Expectations of Modest Fed Rate Cuts, While Sterling Weakens on Inflation Data

The U.S. dollar advanced on Wednesday, hovering near two-month highs as market expectations of modest Federal Reserve rate cuts supported the currency. Meanwhile, the British pound saw a significant drop after inflation data suggested a softer economic outlook. Dollar Gains Amid Adjusted Rate Cut Expectations The Dollar Index, which measures …

Read More »Dow Jones hits resistance 16/10/2024

Oil, Crude, trading

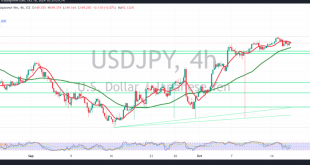

Read More »USD/JPY Seeks Additional Momentum 16/10/2024

japanese-yen

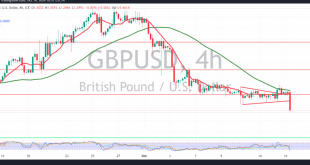

Read More »GBP falls against USD 16/10/2024

Oil, Crude, trading

Read More »Oil: Negative pressure persists 16/10/2024

US crude oil futures experienced a significant decline, hitting the target of $69.65 as mentioned in the previous report, with a recorded low of $69.73 per barrel. The bearish double top pattern on the 4-hour chart continues to exert negative pressure, indicating the potential for the downtrend to persist. As …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations