Gold prices have continued their historic climb, reaching $2790 per ounce after surpassing the previous peak of $2758. Technical Analysis: The 4-hour chart shows that simple moving averages continue to support the upward momentum, while the momentum indicator remains strong above the 50 midline, indicating a sustained bullish outlook. For …

Read More »Euro holds steady below resistance 31/10/2024

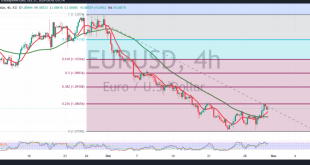

The EUR/USD pair has reaffirmed its 1.0865 resistance level but failed to break through it in the last session. Technical Analysis: A closer look at the 4-hour chart shows that the 50-day simple moving average supports a potential decline, with the stochastic indicator gradually losing upward momentum. While technical indicators …

Read More »Market Drivers; US Session

The US dollar’s Pause: A Temporary Respite?The US Dollar Index (DXY) has recently shown signs of fatigue, retreating from its recent highs. Despite encouraging economic data, including strong job growth, the US dollar’s relentless ascent appears to be pausing.Key Economic Events to Watch – United StatesPersonal Consumption Expenditure (PCE) Price …

Read More »US Dollar Pauses Ahead of Key Data

The US Dollar softened on Wednesday as mixed economic data emerged. While the ADP Employment Change report for September exceeded expectations, signaling robust job growth in the private sector, the downward revision to Q3 GDP growth tempered optimism. This conflicting data painted a nuanced picture of the US economy, leaving …

Read More »Gold’s Meteoric Rise: A Safe-Haven Surge

Gold, the timeless haven asset, has recently surged to unprecedented heights, reaching a record high of $2,790. This meteoric rise is a testament to its enduring appeal as a safe-haven asset during times of economic uncertainty and geopolitical turmoil. Gold’s recent surge is a testament to its enduring appeal …

Read More »A Shifting Currency Landscape: Eurozone Strengthens, Dollar Weakens

The foreign exchange market has been witnessing intriguing dynamics, primarily driven by the divergent economic trajectories of the Eurozone and the United States. The Euro has surged against the US Dollar, reflecting a confluence of factors that have propelled the Eurozone economy and dampened the appeal of the dollar.The recent …

Read More »US Dollar Weakens Following Key US Data

The US Dollar weakened on Wednesday following the release of mixed economic data. While the ADP Employment Change report for September showed a stronger-than-expected increase in private sector payrolls, revising the previous month’s figure upward to 159,000 jobs, the downward revision to third-quarter GDP growth to 2.8% dampened investor sentiment. …

Read More »Is Bitcoin’s Bullish Momentum Continuing Toward Fresh All-time High?

Bitcoin (BTC) has been on a remarkable upward trajectory, flirting with new all-time highs. On Tuesday, it reached a peak of $73,620, fueled by strong institutional demand, particularly from US spot Bitcoin ETFs. These ETFs saw a significant inflow of $827 million, the third-largest single-day inflow since their launch.Analysts believe …

Read More »AI-Fueled Growth: Meta’s Q3 Earnings and Future Outlook

Meta Platforms (META) delivered a strong third-quarter performance, surpassing analyst expectations and fueled by the increasing adoption of artificial intelligence (AI). The company’s revenue surged to $40.59 billion, driven by a robust 18.6% increase in advertising revenue. This growth can be attributed to the successful integration of AI into Meta’s …

Read More »Canadian Dollar Holds Steady Amidst Mixed US Economic Data

The Canadian Dollar (CAD) maintained a relatively neutral stance against the US Dollar (USD) on Wednesday, as mixed economic data from the United States created a tug-of-war in the currency markets. While the USD initially gained ground due to a stronger-than-expected ADP Employment Change report, it subsequently faced downward pressure …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations