Oil, Crude, trading

Read More »Oil settles below resistance 18/11/2024

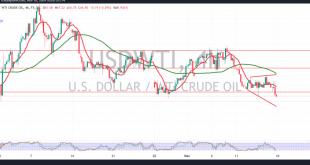

US crude oil futures experienced sharp declines at the start of the week, bottoming out at $66.84 per barrel. From a technical standpoint, the 4-hour chart reveals that oil prices have decisively broken below the support level of $68.65. The persistent downward pressure from the simple moving averages continues to …

Read More »Gold: Negative pressure continues 18/11/2024

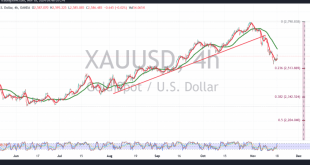

Gold prices fell at the end of last week’s trading, breaking below the support line of the ascending channel, as highlighted in the previous report. This break extended losses, with gold reaching a low of $2554 per ounce. From a technical analysis perspective, gold has attempted to stage a minor …

Read More »Euro expected to fall further 18/11/2024

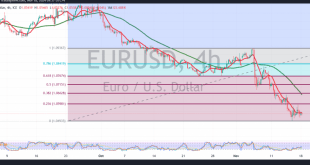

The US dollar continues to exert downward pressure on the euro, hitting the first official target highlighted in the previous technical report at 1.0510, with a recorded low of 1.0515. From a technical standpoint, and based on a closer analysis of the 4-hour chart, the pair remains stable below the …

Read More »Markets’ Weekly Recap: Stronger US dollar dominates performance of key assets

Easing labour market conditions are expected to encourage the Fed to deliver a third interest rate cut next month, even as progress in lowering inflation has stalled. Markets now see a 76% probability of a 25-basis-point rate cut by the Fed in December. Gold has plunged over $170 following the …

Read More »Dow erases recent gains, declines over 350 points

The Dow Jones Industrial Average suffered a significant setback on Friday, plummeting over 350 points and erasing much of the recent post-election rally. This sharp decline reflects growing investor concerns about the economic outlook and potential policy shifts. A key factor contributing to the market’s downturn was the release of …

Read More »Fed’s Goolsbee: The Fed needs to focus on longer trends

Federal Reserve Bank of Chicago President Austan Goolsbee noted on Friday that markets tend to overreact to interest rate changes and that the Fed should maintain a slow and steady approach to reaching the neutral rate.Key QuotesIn regards to a December rate cut or pause. I don’t like tying our …

Read More »Fed’s Collins sees no urgency to cut US interest rates

Federal Reserve Bank of Boston President Susan Collins hit the wires on Friday, downplaying pressures for continued rate cuts in the near term, but also keeping a steady hand underneath market expectations of a rate trim in December.Key QuotesThere’s no preset path for monetary policy.The economy is in a very …

Read More »Wall Street loses ground after Powell urges caution on rate cuts

Wall Street’s main indexes fell on Friday after Federal Reserve Chair Jerome Powell said there was no need to rush interest rate cuts, pushing up U.S. Treasury yields and pressuring equities. Powell pointed to ongoing economic growth, a solid job market, and inflation above the Fed’s 2% target as reasons …

Read More »US Dollar Rallies as Fed Hints at Rate Pause, Geopolitical Tensions Rise

The US Dollar surged on Friday, extending its winning streak to six consecutive days. This rally was primarily fueled by a shift in market sentiment following comments from Federal Reserve Chair Jerome Powell, who tempered expectations of an imminent interest rate cut.Powell’s hawkish tone, emphasizing the strength of the US …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations