Negative trading dominated the pound sterling against the Japanese yen, as we expected touching the second target to be achieved during the last report, located at 151.90, recording the lowest price of 151.97. On the technical side, today we are inclined in our trading to the negative, relying on the …

Read More »Canadian Dollar: Continues The Bullish Trend

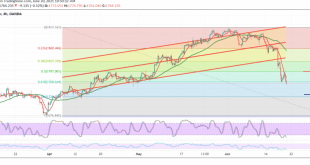

A noticeable bullish push for the Canadian dollar achieved strong gains within the bullish corrective slope, as we expected during the previous analysis, touching the required official target of 1.2465, recording the highest price at 1.3481. Technically, the bullish trend is still a valid scenario, with the pair’s success in …

Read More »The Pound Continues to Witness Losses Against The Dollar

Oil, Crude, trading

Read More »Crude Oil May Start a Bearish Corrective Slope

Oil, Crude, trading

Read More »Gold is Macing More Selling Pressure

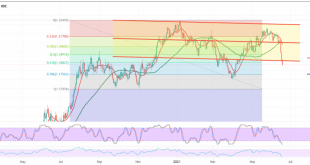

We adhered to intraday neutrality during the previous analysis, explaining that resuming the decline requires stability below 1800, in addition to confirming the break of 1768, so that gold managed to approach the desired target 1759, recording its lowest level at 1760. Today’s technical outlook indicates the possibility of continuing …

Read More »Euro: Negative Pressure Remains

The bearish wave is still dominating the euro against the US dollar after slight positive movements through which the pair returned the previously broken support level 1.1880/1.1890. Technically, the bearish trend is still a valid and effective scenario, as a result of the pair continuing to obtain negative pressure coming …

Read More »Weekly Recap: 14-18 June

Last week witnessed an event that had been anticipated by markets for some time, as the Federal Reserve policy meeting surprisingly saw a hawkish change in tone with the Federal Open Market Committee (FOMC) seeing interest rate hikes sooner than previously expected. The Fed is now expecting raising interest rates …

Read More »Fed Officials Express Varied Opinions on Rate Hikes

The President of the Federal Reserve Bank of St. Louis, James Bullard, is expecting an interest rate hike in 2022, due to the rise in inflation rate above the 2% target. “We were expecting a good year, but this is a bigger year than we were expecting, more inflation than …

Read More »Wall Street Record Weekly Losses on Fed’s Hawkish Tone

The main indices of the New York Stock Exchange (NYSE) closed lower on Friday, amid concerns about the hawkish tone by the Federal Reserve, with Wall Street worrying about raising interest rated sooner than expected. The Dow Jones Industrial Average declined by 533.37 points, or 1.58%, and closed at 33,290 …

Read More »Oil Maintains Gains for Fourth Week in Row

Oil prices rebounded on Friday, with crude futures recovering on the back of positive expectations for demand recovery despite the U.S. Dollar (USD) surge after the hawkish change in tone by the Federal Reserve. Brent crude futures for August delivery increased by 43 cents, or 0.6%, and closed at the …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations