The British pound presented negative trades against the Japanese yen during the previous trading session, to touch the awaited target of 153.60. On the technical side, we tend to the negativity, relying on the clear negativity features on stochastic, missing the bullish momentum, in addition to the stability of trading …

Read More »Canadian Dollar: Touches The Bullish Correction

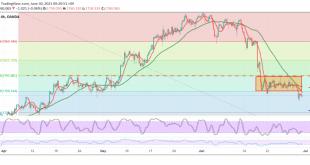

The Canadian dollar was able to breach the resistance level published during the previous analysis, located at the price of 1.2330, which you mentioned that its breach is a catalyst that enhances the chances of rising to complete the bullish correction with the aim of 1.2410, recording its highest level …

Read More »The Pound Confirms the Break

Oil, Crude, trading

Read More »Crude Oil Rebounds After Touching Support And Eyes Are on Stocks

Oil, Crude, trading

Read More »Gold Continues to Touch Bearish Goals

Gold prices incurred noticeable losses during the previous trading session within the expected bearish context, touching the second official target station in the last analysis, at 1753, and recording the lowest at 1750. Today’s technical vision indicates the possibility of continuing the decline, relying on confirming the breach of 1768 …

Read More »The Euro is Hovering Around Support And Confirming the Break Extends The losses

The euro maintains a gradual bearish tendency against the US dollar due to trading stability below the strong resistance level located at 1.1975, to start pressing on the 1.1880 support level. On the technical side today, and with a careful look at the 240-minute chart, we find the simple moving …

Read More »When Should ECB Scale Back Asset Purchases?

Germany’s Jens Weidmann, a member of the European Central Bank (ECB) board, believes that scaling back the massive stimulus needs to be step-by-step after reopening and achieving recovery. These are the two prerequisites for reducing the monetary easing policies, according to the governor of the Deutsche Bundesbank, who was speaking …

Read More »EUR/USD Declines for Second Day in Row

The Euro (EUR) declined on Tuesday as the U.S. Dollar (USD) rose across the board with Treasury bond yields rebounding ahead of the jobs data. The EUR/USD pair lost 0.21% to reach 1.1899, its biggest loss and lowest level since June 18. This is the second consecutive daily loss for …

Read More »GBP/USD Closes at Lowest Level Since June 18

The British Pound (GBP) resumed losses against a stronger U.S. Dollar (USD), with the latter rising on the back of a rebound by Treasury bond yields. In addition, the Sterling remains impacted by the uncertainty surrounding plans to reopen the U.K. despite concerns about the coronavirus Delta variant. Today, the …

Read More »Wall Street Close with Modest Gains and New Records

The New York Stock Exchange (NYSE) closed modestly higher on Tuesday, with the technology stocks leading the gains in Wall Street and investors awaiting economic data, especially the upcoming jobs report, to asses the possible impact on monetary policy and interest rates. The S&P 500 and the Nasdaq Composite continued …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations