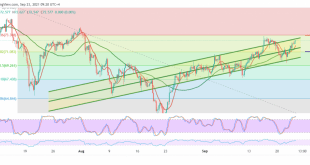

Oil, Crude, trading

Read More »Gold Breaks Support

Gold’s movements witnessed random trades affected by the Federal Reserve’s decisions yesterday, with total bearish performance, to witness intraday stability below 1774, and in general, below 1780. On the technical side today, looking at the 240-minute chart, we notice the negative impact of the bearish technical structure shown on the …

Read More »The Euro Continues to The Negative Side

Mixed trading dominated the euro’s movements against the US dollar. The euro is still facing negative pressure for the fourth consecutive session, unable to breach the strong resistance level published during all the technical reports over the week at 1.1750. Technically, the euro continues its negative crawling to the downside …

Read More »Bank Of England: Hawkish Hints Unlikely

The Bank of England will hold a monetary policy meeting and will announce its decision on Thursday, September 23rd; markets are widely expecting the central bank to keep the key rate unchanged at 0.1%. The Bank of England expanded its Asset Purchase Facility to £875 billion between March and November …

Read More »Eurozone consumer confidence rises beyond expectations

The Eurozone’s consumer confidence index has risen in September as the spread of the Delta variant was managed and controlled as continent wide lockdown restrictions were eased.The European Commission said Wednesday that its measure of consumer confidence in the single-currency area rose to -4 (flash) from -5.3 in August. This …

Read More »Stock benchmarks gain around 1.0% each as Powell flagged taper

U. S. shares have ended the key trading sessions surprisingly on a positive side, despite the Federal Reserve’s hint for tapering. The market’s reaction to the Federal Reserve’s announcements was originally expected to represent a low and favored securities, which kept the gains even as Chairman Jerome Powell supported the …

Read More »Most important outcomes of Powell’s statements

Federal Reserve Chair Jerome Powell indicated that job gains have been very strong since January, but in August employment data slowed down markedly, particularly in leisure and hospitality sectors.Powell seemed optimistic about “Virus fears weighing on employment growth”, and expected that such concerns “should diminish over time”.Powell’s statements were as …

Read More »Federal Reserve issues FOMC statement (Full text)

The Federal Reserve is committed to using its full range of tools to support the U.S. economy in this challenging time, thereby promoting its maximum employment and price stability goals.With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen. The sectors most …

Read More »Powell: Bond tapering could conclude by middle of 2022

Federal Reserve Chair Jerome Powell, in a press conference, said central bank members forecast a tapering of the pandemic-era bond buying program ending around the middle of 2022.“Participants generally view, so long as the recovery remains on track, gradual tapering process that concludes around the middle of next year is …

Read More »Fed Leaves Policy Rate Unchanged

The Federal Open Market Committee (FOMC) announced on Wednesday that it left the benchmark interest rate, the target range for federal funds, unchanged at 0%-0.25% as widely expected. In its policy statement, the Fed noted that if progress continues toward employment and inflation goals broadly as expected, a moderation in …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations