European shares fell at the beginning of Wednesday’s trading, led by shares of food and beverage companies and with global stock markets losses. Economic data in the UK revealed that inflation rose to a 30-year high in December at 5.4%, exceeding analysts’ expectations of 5.2%. “We’re hearing a lot of …

Read More »Nikkei Index Falls to Its Lowest Level in 5 Months

Nikkei index falls to its lowest level in 5 months, affected by the decline of Toyota and Sony Toyota’s stock fell 4.97% after it said it expected not to achieve its goal of selling 9 million vehicles annually due to the chip shortage crisis. 12 shares rose on the Nikkei …

Read More »Inflation in Britain Has Risen to Its Highest Level in 30 Years

UK inflation rose to a 30-year high in December, as rising energy costs, rising demand and supply chain problems continued to push up consumer prices. The inflation rate reached 5.4% annually, the highest level since March 1992, and an increase from 5.1% in November, which is itself the highest level …

Read More »German Dax: Negative Pressure is in Place 19/1/2022

The German DAX index failed to achieve the temporary positive outlook published during the previous analysis. We mentioned that breaking 15,880 puts the index’s price under intense negative pressure, targeting 15,800, to record the lowest price of 15,655. Technically, and carefully looking at the 4-hour chart, we notice that the …

Read More »Dow Jones is Witnessing Heavy Losses 19/1/2022

Oil, Crude, trading

Read More »GBP/JPY: Breaks Support 19/1/2022

Negative trading has regained control over the movements of GBP/JPY after it failed to maintain trading above the 155.90 support level, which forced the pair to trade with clear negativity during the early trading of the current session. On the technical side today, we notice the negative pressure coming from …

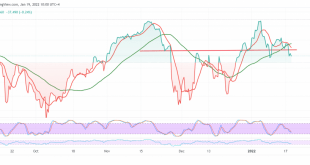

Read More »The Canadian Dollar: Technical Conditions Unchanged 19/1/2022

The technical outlook is unchanged and the movements of the US dollar against the Canadian dollar did not change significantly, maintaining the same technical conditions of the previous session. Technically, there is a conflict in the technical signals between the RSI attempts to obtain positive signals that increase the possibility …

Read More »The British Pound is Below The Moving Average 19/1/2022

Oil, Crude, trading

Read More »Oil Extends Its Gains 19/1/2022

Oil, Crude, trading

Read More »Gold Gradually Falls to The Down Side 19/1/2022

The movements of the yellow metal witnessed a negative trading session yesterday, and as a reminder, we indicated that we are waiting to confirm the breach of the 1810 level, and this increases the negativity to target 1803 so that gold approaches the required target, recording 1805 Technically, and carefully …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations