The movements of the German DAX index witnessed negative trading, recording its lowest level at 15,110 after it recorded the highest at 15,500. Technically, by looking at the 60-minute chat, we notice that the stochastic indicator continues to receive negative signals, accompanied by the momentum indicator gaining negative signals on …

Read More »Dow Jones: Negative Pressure in Place 14/2/2022

Oil, Crude, trading

Read More »GBP/JPY: Consolidate Above 14/2/2022

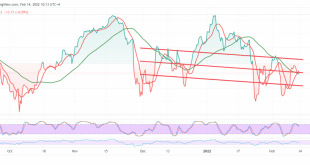

The Canadian dollar is trying to maintain its recent gains during last week’s trading, after it sought to establish a solid support floor around 1.2665, to witness intraday movements stability above 1.2700. Technically, the return of the simple moving averages provides a positive motive and the clear positive crossover signs …

Read More »The Canadian is Trying to Consolidate Above The Support 14/2/2022

The Canadian dollar is trying to maintain its recent gains during last week’s trading, after it sought to establish a solid support floor around 1.2665, to witness intraday movements stability above 1.2700. Technically, the return of the simple moving averages provides a positive motive and the clear positive crossover signs …

Read More »GBP: Below The Psychological Barrier 14/2/2022

Oil, Crude, trading

Read More »Oil Jumps to The Upside 14/2/2022

Oil, Crude, trading

Read More »Gold is Rushing Upwards 14/2/2022

The prices of the yellow metal surged remarkably at the end of the trading week that ended last Friday, recording its highest level around $1,865 per ounce, after it succeeded in breaching the resistance level of 1836. From the angle of technical analysis today, we notice that the 14-day momentum …

Read More »The Euro Settled Below Support 14/2/2022

The movements of the Euro against the US dollar witnessed a mixed session, approaching by a few points from the first official station targeted in the previous analysis at the price of 1.1510, posting the highest level of 1.1495, to trade again on the negative side due to approaching the …

Read More »Weekly Recap 7-11 February

Tensions between Ukraine and Russia escalated all along the five trading days. This was sending markets into a flux with the usual risk assets and currencies responding in a mixed manner. There was news that a Russian attack on Ukraine could begin any day and would likely start with air …

Read More »Market Drivers – US Session – 11 February 2022

The US Treasury yields have been declining since the beginning of the daily trading on Friday, after consumer confidence data and their negative impact on the future of the US economy and economic recovery.Economic DataAccording to the University of Michigan’s preliminary February Consumer survey, the Consumer Sentiment Index fell to …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations