Gold prices maintained a steady upward trajectory in Asian trade on Thursday, staying close to their record highs as fears surrounding the U.S.-China trade war continue to fuel demand for safe-haven assets. Gold Market Update Spot Gold: $2,869.17 (+0.1%) Gold Futures (April): $2,887.90 (-0.2%) Record High: $2,882.53 (hit on Wednesday) …

Read More »Bitcoin Holds Steady as U.S.-China Trade Tensions Weigh on Market

Bitcoin remained largely stable on Friday, reflecting muted risk appetite amid escalating trade tensions between the U.S. and China. Meanwhile, MicroStrategy (NASDAQ:MSTR) reported its fourth consecutive quarterly loss, though it continued expanding its Bitcoin holdings. Bitcoin Market Update Bitcoin (BTC/USD): $97,742.7 (-0.3%) as of 00:35 ET (05:35 GMT) Market Sentiment: …

Read More »Dow Jones Jumps Higher 6/2/2025

Oil, Crude, trading

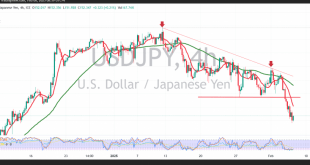

Read More »USD/JPY: Downside pressure persists 6/2/2025

japanese-yen

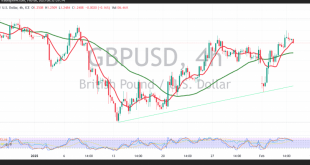

Read More »GBP ahead of USD 6/2/2025

Oil, Crude, trading

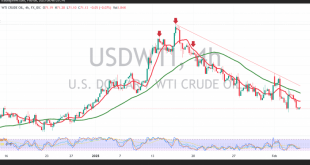

Read More »Oil suffers huge losses 6/2/2025

WTI crude oil continues its losing streak for the third consecutive session, now testing the psychological support at $71.00. Technical Outlook: Moving averages exert downward pressure, reinforcing the bearish bias. Price remains below the previously broken support at 72.40, which has now turned into resistance. Key Levels to Watch: Bearish …

Read More »Gold may continue to rise 6/2/2025

Gold prices successfully reached the target of 2870 in the previous session, recording a new high at $2882 per ounce. Technical Outlook: Moving averages continue to support an upward trend. Gold remains within an ascending price channel, with 2840 acting as a key support level. Key Levels to Watch: Bullish …

Read More »Euro may resume temporary rise 6/2/2025

The EUR/USD pair experienced a temporary bullish rebound in the previous session, recovering from the psychological support at 1.0200 and reaching a high of 1.0442. Technical Outlook: The Stochastic indicator is attempting to gain bullish momentum, supporting the possibility of further upside. The pair is holding above the previously breached …

Read More »Gold Prices Peak, Face Fresh Challenges

Gold’s relentless climb has propelled it to unprecedented heights, reaching a record peak. However, this impressive rally has also triggered overbought conditions, raising the specter of a potential pullback. While the long-term bullish trend remains intact, traders are now closely monitoring key support levels for signs of a potential correction. …

Read More »USD/JPY Freefall: 1.13% Drop Signals Deeper Downtrend

The USD/JPY currency pair experienced a significant drop, falling 1.13% to 152.59. This sharp decline occurred as the pair decisively broke through both the 200-day Simple Moving Average (SMA) and the Ichimoku Cloud (Kumo), signaling a strengthening downtrend and potential appreciation of the Japanese Yen.The 175-pip drop on Wednesday confirms …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations