Oil, Crude, trading

Read More »The Dow Jones is back for gains 11/4/2022

Oil, Crude, trading

Read More »CAD facing negative pressure 11/4/2022

There were positive attempts by the Canadian dollar to achieve the expected bullish rebound at the end of last week’s trading, recording its highest level around the psychological resistance level of 1.2600. Technically, the pair’s current movements are witnessing a bearish tendency as a result of the negativity features that …

Read More »GBP trying to bounce back 11/4/2022

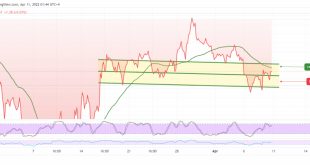

Oil, Crude, trading

Read More »Gold breaks out of the sideways range 11/4/2022

After several consecutive sessions of our commitment to neutrality, waiting for the gold price to exit the sideways range between 1925 and 1940, explaining that activating purchase orders depends on gold’s ability to penetrate 1940 to target 1948, recording its highest price last Friday’s transactions 1948. From the angle of …

Read More »Euro May Retest Resistance 11/4/2022

The euro continues its negative movements against the US dollar within the expected bearish context, approaching the target during the last analysis, at 1.0820, recording the lowest level at 1.0836. Technically today, and by looking at the 4-hour chart, we notice the continuation of the movement below the 50-day moving …

Read More »EUR Benefits From French Elections As Macron leads 54%, le Pen 46%

Emmanuel Macron and Marine Le Pen are running a fierce competition against each other in the final round of the French presidential election and the latest poll. Macron is leading 54% versus Le pen’s 46%.The euro is trading 0.25% in the open. Official results of the election are expected later …

Read More »Weekly Market Recap 4-8 April

It has been an eventful week as the US dollar played some competing roles. This has frustrated some traders, seeking to interpret and know how to deal with critical developments such as the FOMC’s first rate hike in years in light of several Fed speakers during the week.First and foremost, …

Read More »Market Drivers – US Session – 8 April

The EUR/USD pair remains pressured and aims at finishing the week on the wrong foot amidst a mixed market sentiment. The EUR/USD is trading at 1.0876 as traders prepare for the weekend.Geopolitics and hawkish Fed keep market sentiment mixed. Investors’ mood was mixed during the North American session. US equities …

Read More »Germany To Stop Russian Gas Imports ‘Very Soon’

German chancellor, Olaf Scholz, said that Germany is doing all it can to wean itself off Russian energy, but declined to endorse a claim by Boris Johnson that it would stop importing Russian gas by the middle of 2024.Scholz said only that the goal would be achieved very soon, and …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations