European shares fell as traders intensified their bets on raising the interest rate after statements tending to tighten from central bank officials, while shares of the German software giant SABB and French luxury goods Kering fell after the two companies announced the results of the first quarter of the year. …

Read More »The euro is falling after statements from the European Central

The euro fell on Friday after officials from the European Central Bank made mixed statements, while the dollar was supported by expectations of a 50 basis point interest rate hike from the Federal Reserve. European Central Bank President Christine Lagarde gave some indication of easing by saying that the bank …

Read More »Japanese stocks close lower, pressured by the decline of Wall Street, and Toshiba shares jump

Japanese shares closed lower on Friday for the first time in four sessions, tracking Wall Street, which fell overnight after the Fed’s interest rate views, while Toshiba shares rose sharply after opening the door to acquisitions. The Nikkei index ended the session down 1.63 percent, recording 27,105.26 points, while the …

Read More »Oil is heading for a weekly decline of about 4% as demand concerns persist

Oil prices fell on Friday, heading towards a weekly decline of about four percent, affected by expectations of higher interest rates, weak global growth and restrictions to combat Covid-19 in China, which negatively affected demand, although the European Union is considering banning Russian oil imports. By 0130 GMT, Brent crude …

Read More »German Dax loses momentum 22/4/2022

Oil, Crude, trading

Read More »Dow Jones facing strong selling 22/4/2022

Oil, Crude, trading

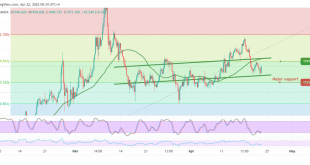

Read More »CAD building on support 22/4/2022

The pivotal support levels at 1.2460 managed to limit the bearish bias, which forced the pair to rebound bullishly again, heading to touch the required retest target at 1.2660, bypassing the target to record the highest 1.2590. Technically and carefully considering the 4-hour chart, the positive signs on the stochastic …

Read More »The pound faces strong resistance 22/4/2022

Oil, Crude, trading

Read More »Gold is looking for a catalyst 22/4/2022

Limited positive attempts were witnessed by gold’s movements yesterday, unable to breach the pivotal resistance level at 1959, which forced the price to touch the 1936 level. Technically, gold prices got additional support due to the intraday stability above the 1940 support floor. However, with a careful look 240-min chart, …

Read More »The euro hits the resistance, facing negative pressure 22/4/2022

The single European currency managed to target retesting at 1.0920, recording a high of 1.0936, to return to trading with noticeable negativity due to hitting the resistance level. On the technical side, the euro’s moves returned to stability below the resistance level of 1.0880, most importantly below the psychological resistance …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations