The U.S. economy contracted at an annual rate of 0.5% in the first quarter of 2025, marking a worse-than-expected decline, according to the latest data released by the U.S. Bureau of Economic Analysis (BEA) on Thursday. This figure was a revision downward from the previously reported -0.2%, signaling a more …

Read More »U.S. Jobless Claims Fall, but Continuing Unemployment Claims Rise

The number of U.S. citizens filing new applications for unemployment insurance decreased to 236,000 for the week ending June 21, as reported by the U.S. Department of Labor (DOL) on Thursday. This figure came in lower than both initial estimates and the previous week’s revised total of 246,000 (which had …

Read More »Bitcoin Rises Amid Institutional Demand; Ceasefire Boosts Risk Sentiment

Bitcoin showed some positive movement on Thursday, rising by 1.4% to $107,751.9 as risk appetite continued to benefit from the ongoing ceasefire between Israel and Iran, though it remained within a familiar trading range. The largest cryptocurrency’s price remained below its weekly high of over $108,000, signaling that while momentum …

Read More »UK Retail Sales See Sharp Decline in June Amid Tough Consumer Conditions

Retail sales in the UK faced a significant downturn in June, as the latest survey by the Confederation of British Industry (CBI) revealed a deeper contraction in sales activity compared to May. The CBI’s monthly retail sales gauge, which compares sales figures to those from the same time last year, …

Read More »European Markets Rise on Ceasefire Hopes, Powell’s Testimony, and Crude Prices

European stocks gained ground on Thursday as investors tracked the fragile Israel-Iran ceasefire, the looming U.S. tariff deadline, and the latest comments from Federal Reserve Chair Jerome Powell. By 03:15 ET (07:15 GMT), the DAX index in Germany was up 0.5%, the CAC 40 in France climbed 0.4%, and the …

Read More »Gold Prices Steady Amid Weaker Dollar; Trump Criticizes Fed Chair Powell as Israel-Iran Ceasefire Holds

Gold prices found some support in Asian trade on Thursday, as a weaker dollar helped to stabilize bullion prices. Spot Gold remained largely unchanged at $3,336.65 an ounce, while Gold Futures for August rose 0.1% to $3,347.45/oz by 01:08 ET (05:08 GMT). Earlier in the week, gold saw sharp losses …

Read More »Oil Prices Edge Up Amid Strong U.S. Demand Data

Oil prices made modest gains in Asian trade on Thursday, boosted by a larger-than-expected draw in U.S. oil inventories, which sparked some optimism around demand. However, the potential for further increases remained tempered by the sustained ceasefire between Israel and Iran, which has reduced concerns over potential disruptions in Middle …

Read More »Dow Jones Rally Pauses at Key Technical Levels 26/6/2025

Oil, Crude, trading

Read More »CAD Struggles to Maintain Upbeat Momentum in a Cautious Market 26/6/2025

The USD/CAD pair exhibited cautious bullish behavior yesterday, aligning with the expected upward scenario and reaching a high near the key resistance level of 1.3760. From a technical standpoint today, the 240-minute chart reveals continued support from the simple moving averages, which are reinforcing the bullish sentiment. Additionally, the Relative …

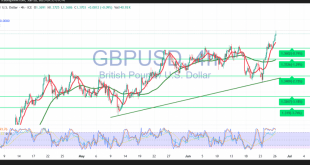

Read More »Bullish Signal? GBP Pushes Through Resistance with Confidence 26/6/2025

Oil, Crude, trading

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations