There were 218,000 Initial Jobless Claims in the week ending on 14 May, a tad above the expected rise to 200,000 from 197,000 one week ago, data released by the US Department of Labour on Thursday showed. That meant the four-week average number of claims rose to 199,500 from 191,250 a week …

Read More »The dollar’s decline revives gold prices amid fears of weak growth

Gold prices rebounded again on Thursday as a weaker dollar and lower US Treasury yields coupled with a drop in risky assets revived demand for the precious metal, which is considered a safe haven for value amid concerns about global growth. The price of gold in spot transactions jumped 0.8 …

Read More »European shares fell, affected by the decline in retail and US stocks

European shares fell 1.7 percent on Thursday after heavy selling on Wall Street, as weak results from retail companies highlighted the impact of high inflation on the world’s largest economy. European retail stocks fell, following in the footsteps of their American counterparts, by 2.4 percent and was the biggest loser …

Read More »The euro is recovering a little and the focus is on the ECB’s policy

The euro rebounded somewhat on Thursday after investors digested the possibility that the European Central Bank would tighten monetary policy aggressively in the near term, while the safe-haven dollar picked up a breath after making big gains in previous sessions. Financial markets are currently expecting a 106 basis point hike …

Read More »Japan says it will double financial support to Ukraine to 600 million dollars

Japanese Prime Minister Fumio Kishida told reporters on Thursday that his country will double its financial aid to Ukraine to $600 million in a coordinated move with the World Bank to support the near-term financial necessities of the Russian-invaded country. “Our country stands by Ukraine,” Kishida said, adding that Japan …

Read More »Dow Jones incurs heavy losses 19/5/2022

Oil, Crude, trading

Read More »GBP/JPY: Building on Support 19/5/2022

The British pound declined noticeably yesterday, within the scenario of retesting the support, as we expected, touching the official target station at 159.20, recording its lowest level at 157.90. Technically, and with careful consideration of the 4-hour chart, the pair found a strong support floor around 158.50, which forced it …

Read More »CAD is facing negative pressure 19/5/2022

Mixed trades dominated the movements of the Canadian dollar during the last session’s trading to succeed in retesting the resistance level required to be touched during the previous analysis at 1.2895, recording its highest level at 1.2895. Technically, the 50-day simple moving average started to pressure the price from above, …

Read More »GBP in favor of the downtrend 19/5/2022

Oil, Crude, trading

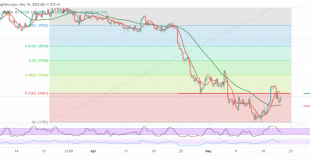

Read More »Gold maintains negative technical conditions 19/5/2022

Gold prices maintained negative stability within the expected bearish context during the previous analysis after finding a strong resistance level around 1827, which forced the price to trade negatively again, maintaining the same technical conditions of the last report. On the technical side, the current moves of gold are witnessing …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations