Japanese stocks had their best day in nearly two weeks on Monday, boosted by positive corporate results, while uncertainty over the global growth outlook kept gains limited. The Nikkei rose 0.7% to close at 27,993 points, and the broader Topix index rose 1 percent to 1960 points, their biggest gain …

Read More »Dow Jones: Positive scenario still stands 1/8/2022

Oil, Crude, trading

Read More »GBP/JPY: awaits further decline 1/8/2022

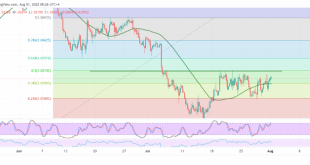

GBP/JPY starts its first weekly trading with a solid bearish tendency after it failed to maintain trading above 162.10, recording its lowest level during the early trading of the current session at 161.27. Technically, the daily trend is still bearish due to stability below the previously broken support-into-resistance, which is …

Read More »CAD resumes the gradual decline 1/8/2022

The negative pressure returned to control the movements of the Canadian dollar after it found a strong resistance level at 1.2855, which forced it to trade negatively to retest 1.2790. Technically, taking a closer look at the 4-hour chart, we are inclined to the negativity based on stochastic losing the …

Read More »GBP maintains gains 1/8/2022

Oil, Crude, trading

Read More »Gold takes advantage of the weak dollar 1/8/2022

The yellow metal prices achieved good gains at the end of last week’s trading for the third consecutive session, after it succeeded in building on the support floor of 1755, recording its highest level of 1767, taking advantage of the weakness of the US currency. Technically, by looking at the …

Read More »Euro is looking for more bullish momentum 1/8/2022

The euro showed upward movements against the US dollar, which continued its descending correction to its lowest level in 3 weeks to record the highest level last Friday at 1.0254. Today’s technical vision indicates the possibility of continuing the bullish bias due to the positive motive coming from the 50-day …

Read More »Financial Markets’ Weekly Recap, July 25-29

US monetary policymakers opted a 75bps rate hike. Markets expected this move; a historically large hike. Jerome Powell explained that Fed would likely stop hiking once inflation is controlled. If unemployment rises, the job market weakens, and the US falls into a recession, Fed would ease policy due to lower …

Read More »Market Drivers – US Session – Friday, July 29

The British pound finished the week recording its second consecutive week in the green territory; it printed solid gains of 1.49%, amidst an upbeat market mood, portrayed by US equities closing higher on Friday. The GBP/USD pair was trading at 1.2170, 0.05% down, during the North American session.US shares finished …

Read More »Oil up nearly $3/bbl on faded chances concerning supply boost

Oil prices rose nearly $3 a barrel on Friday as attention turned to next week’s OPEC+ meeting and dimming expectations that the producer group will boost supply.Brent crude futures for September settlement, due to expire on Friday, gained $2.79, or 2.6%, to trade at $109.93 a barrel by 12:10 p.m. …

Read More » Noor Trends News, Technical Analysis, Educational Tools and Recommendations

Noor Trends News, Technical Analysis, Educational Tools and Recommendations